Table of Contents

- Executive Summary

- Methodology

- The importance of homeownership in the Real Estate Market in Spain

- Current Market Trends

- Rental Cost and Generational Disparities

- Regional Autonomy and Housing Policy Conflicts Regional Adaptation Strategies

- Potential Real Estate Bubble: Evidence and Perspectives

- Supply-Demand Imbalance: Structural Factors and Bureaucratic Constraints

- References

Executive Summary

This report provides a comprehensive analysis of the Spanish real estate market as of 2025, focusing on the emergence of bubble-like conditions and the structural factors underpinning the persistent supply-demand imbalance. Drawing on official data from the Bank of Spain, INE, the Ministry of Housing, and leading sectoral research, the study employs both quantitative and Austrian school economic frameworks to assess market dynamics, investor behavior, and regulatory impacts.

Key findings reveal that Spain is experiencing rapid house price growth—exceeding 11% year-over-year in early 2025—alongside record transaction volumes and a surge in foreign investment, particularly in high-demand regions. These patterns echo those observed prior to the 2008 financial crisis. However, the current cycle is distinguished by a severe housing supply deficit, driven by bureaucratic overregulation, administrative delays, labor shortages, and insufficient public housing provision.

The report identifies bureaucratic inefficiency as the principal constraint on new housing supply, with permit and regulatory delays adding substantial costs and time to development projects. Institutional fragmentation across national, regional, and municipal levels further exacerbates these challenges. Labor market constraints—including an aging construction workforce and persistent skills shortages—compound the sector’s limited responsiveness to rising demand.

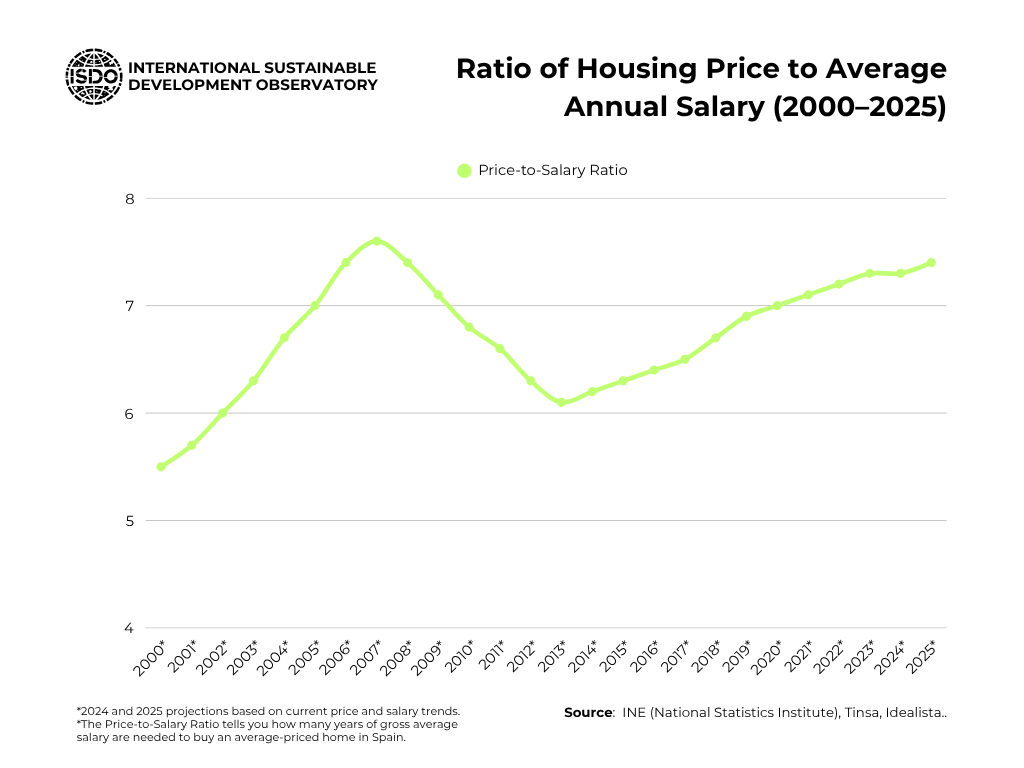

Speculative investment, especially in short-term tourist rentals, is diverting housing stock away from long-term residents and inflating prices in key urban and tourist markets. Affordability has deteriorated sharply, with price-to-income ratios surpassing previous historical highs and a growing share of households facing housing cost burdens.

From an Austrian economics perspective, the report concludes that monetary policy distortions and regulatory interventions have created artificial scarcity and misallocated resources, fueling unsustainable market dynamics. The evidence suggests that, without significant regulatory reform and supply-side intervention, Spain risks experiencing a painful market correction reminiscent of the post-2008 crisis period.

The report concludes with policy recommendations focused on streamlining regulatory processes, enhancing intergovernmental coordination, investing in construction workforce development, and expanding public housing initiatives to restore balance and resilience in the Spanish housing market.

Methodology

Research Design and Methodological Approach

This analysis employs a mixed-methods research design combining quantitative economic analysis with Austrian school theoretical framework to examine the Spanish real estate market’s bubble potential. The study adopts a comprehensive analytical approach that integrates macroeconomic indicator analysis, supply-demand imbalance assessment, and institutional constraint evaluation to provide a holistic understanding of current market conditions.

The research methodology follows the praxeological tradition of Austrian economics, which emphasizes logical deduction from fundamental axioms of human action rather than empirical testing of hypotheses. This approach allows for the identification of market distortions and malinvestment patterns characteristic of artificial boom-bust cycles without relying solely on statistical correlations.

Data Collection Methods

Primary Data Sources

The analysis relies primarily on official Spanish government statistics and regulatory institution reports to ensure data reliability and validity. Key data sources include:

- Bank of Spain (Banco de España): Housing price indices, mortgage lending statistics, household debt ratios, and financial stability assessments

- Instituto Nacional de Estadística (INE): Population demographics, employment statistics, construction sector data, and housing transaction volumes

- Ministry of Housing and Urban Development: Building permit data, urban planning statistics, and housing policy documentation

- Regional Statistical Offices: Autonomous community-specific housing market data and regulatory information

Secondary Data Integration

The methodology incorporates complementary data from specialized real estate platforms and industry associations to validate official statistics and provide market-level insights. These sources include property portal transaction data, construction industry reports, and professional real estate association publications.

Analytical Framework

Comparative Historical Analysis

The study employs temporal comparative analysis to identify parallels between current market conditions and the pre-2008 bubble period. This approach involves:

- Price Growth Pattern Analysis: Comparing current price acceleration rates with historical bubble formations

- Transaction Volume Assessment: Evaluating current market activity levels against historical peaks

- Credit Market Condition Comparison: Analyzing lending standards and monetary policy impacts across different periods

Multi-Dimensional Market Analysis

The research applies a comprehensive market analysis framework examining three primary dimensions:

- Macroeconomic Indicators: Price growth rates, transaction volumes, foreign investment flows, and affordability metrics

- Supply-Demand Dynamics: Housing construction rates, demographic pressures, and inventory levels

- Institutional Constraints: Regulatory frameworks, bureaucratic processes, and policy implementation effectiveness

Austrian Business Cycle Theory Application

The analysis integrates Austrian business cycle theory to identify artificial boom conditions created by monetary policy distortions and regulatory interventions. This theoretical framework provides the conceptual foundation for distinguishing between sustainable market growth and speculative bubble formation.

Quantitative Analysis Techniques

Statistical Methods

The study employs several quantitative analysis techniques appropriate for real estate market research:

- Time Series Analysis: Examining price trends, transaction volumes, and market indicators over extended periods

- Regression Analysis: Identifying relationships between key variables such as price growth, supply constraints, and demographic factors

- Comparative Index Construction: Developing composite indicators for bubble risk assessment and historical comparison

Data Processing and Quality Control

All quantitative data undergo rigorous quality control procedures including:

- Outlier Detection and Treatment: Identifying and appropriately handling extreme values that might distort analysis

- Data Validation: Cross-referencing statistics across multiple official sources to ensure consistency

- Temporal Alignment: Standardizing data collection periods and frequencies across different sources

Qualitative Analysis Methods

Policy and Regulatory Assessment

The methodology incorporates qualitative analysis of institutional factors affecting housing supply and demand. This includes:

- Regulatory Framework Analysis: Examining building codes, zoning laws, and permit processes across different jurisdictions

- Policy Impact Assessment: Evaluating the effects of housing legislation and urban planning policies on market dynamics

- Institutional Capacity Evaluation: Analyzing administrative capabilities and inter-governmental coordination mechanisms

Case Study Integration

Selected regional markets receive detailed case study treatment to illustrate broader national trends and identify local variations in bubble conditions. These case studies provide context for understanding how national-level patterns manifest in specific geographic markets.

Methodological Limitations and Considerations

Data Availability Constraints

The analysis acknowledges certain limitations in data availability, particularly regarding:

- Construction Sector Demographics: Limited granular data on workforce composition and productivity metrics

- Short-Term Rental Market: Incomplete official statistics on tourist accommodation conversions

- Regional Variations: Inconsistent data collection standards across autonomous communities

Austrian School Methodological Considerations

The praxeological approach emphasizes logical consistency over empirical testing, which provides both advantages and limitations. While this methodology excels at identifying structural market distortions and policy-induced imbalances, it relies on theoretical deduction rather than statistical hypothesis testing.

Temporal Analysis Constraints

Historical comparisons face inherent limitations due to changing market structures, regulatory frameworks, and economic conditions between the current period and 2008. The analysis addresses these constraints by focusing on fundamental market dynamics rather than surface-level statistical similarities.

Research Validation and Reliability

Triangulation Methods

The study employs methodological triangulation by combining multiple analytical approaches:

- Data Source Triangulation: Using multiple official and semi-official data sources to validate findings

- Theoretical Triangulation: Integrating Austrian economic theory with conventional market analysis techniques

- Temporal Triangulation: Examining patterns across different time periods to identify consistent trends

Peer Review and Expert Consultation

The methodology benefits from consultation with Austrian school economists and real estate market specialists to ensure theoretical consistency and practical applicability. This expert input helps validate analytical approaches and interpretive frameworks.

Ethical Considerations

The research adheres to standard academic ethical guidelines regarding data use and source attribution. All data sources are properly cited, and the analysis maintains objectivity in presenting evidence that both supports and potentially contradicts the bubble hypothesis.

The importance of homeownership in the real estate market in Spain.

Homeownership in Spain is a deeply ingrained aspect of the culture and economy, with ownership rates exceeding 80%. This high level of homeownership can be traced back to policies enacted during the Franco era, particularly a National Housing Plan established in 1961, which sought to address housing shortages and encour- aged the aspiration of owning property among Spaniards. Over the decades, this aspiration has become a fundamental part of Spanish identity, influenced by governmental efforts during the 1960s and 1970s that further solidified the emphasis on homeownership as a societal goal.

Despite the strong inclination towards owning property, the rental market has been gradually expanding in recent years, attributed to factors such as job insecurity and low wages, which have made it difficult for many to purchase homes. In 2022, the homeownership rate in Spain was 75%, still surpassing the EU average of 65%, which highlights the limited size of the rental market compared to other European nations. The demand for housing remains high, fueled by a robust economy, population growth, and foreign interest in Spanish real estate.

However, the Spanish real estate market faces significant challenges. A substantial housing crisis persists, characterized by a mismatch between supply and demand, particularly in urban centers like Madrid, Barcelona, and Valencia. This crisis is exacerbated by the existence of over three million vacant homes, many in less populated areas, alongside the influence of property speculation by large investment funds driving up prices in more desirable locations. Additionally, the historical context of the Spanish property bubble, which saw rapid price increases until its collapse in 2008, has left a lasting impact on the market dynamics.

Moreover, the traditional policies favoring homeownership have contributed to a rental market that is one of the smallest in Europe. Fewer than 25% of Spanish households rent their homes, indicating a strong bias towards ownership. This demographic of renters tends to be younger, less affluent, and often immigrants, reflecting the systemic challenges within the housing sector. Thus, while home- ownership remains a central element of the Spanish real estate market, ongoing economic and social issues continue to shape the landscape of housing access and affordability.

Home Ownership Rate: Spain, Germany, and the UK

| Country | Home Ownership Rate (2024–2025) |

|---|---|

| Spain | 73.7% (2024) |

| Germany | 46.7% (2025) |

| UK | 63.2% (2025) |

Current Market Trends

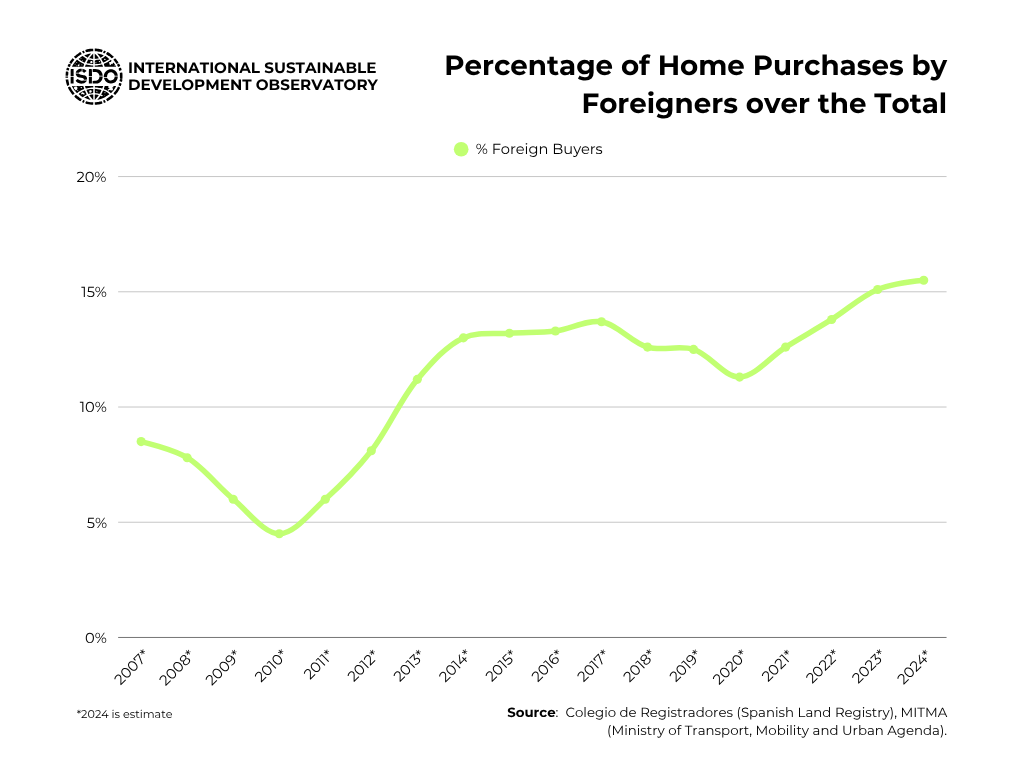

The Spanish real estate market has exhibited significant growth and challenges in recent years, influenced by both domestic and international factors. Foreign investment surged to record levels, with non-resident buyers acquiring over 88,000 properties in 2023, marking a 45% increase compared to previous years. Total foreign investment reached 28.215 billion euros, highlighting the country’s appeal to global investors. This growth is driven by a mix of factors, including global economic trends, legislative changes, and a resurgence in tourism, which has bolstered demand and impacted affordability.

The imbalance between housing supply and demand continues to exacerbate the market’s difficulties, inflating property prices and contributing to concerns about an impending housing crisis. While new homes are being built at a much slower rate than population growth fewer than 100,000 homes annually compared to an increase of over 400,000 people per year the shortage of supply is pushing prices further upward.

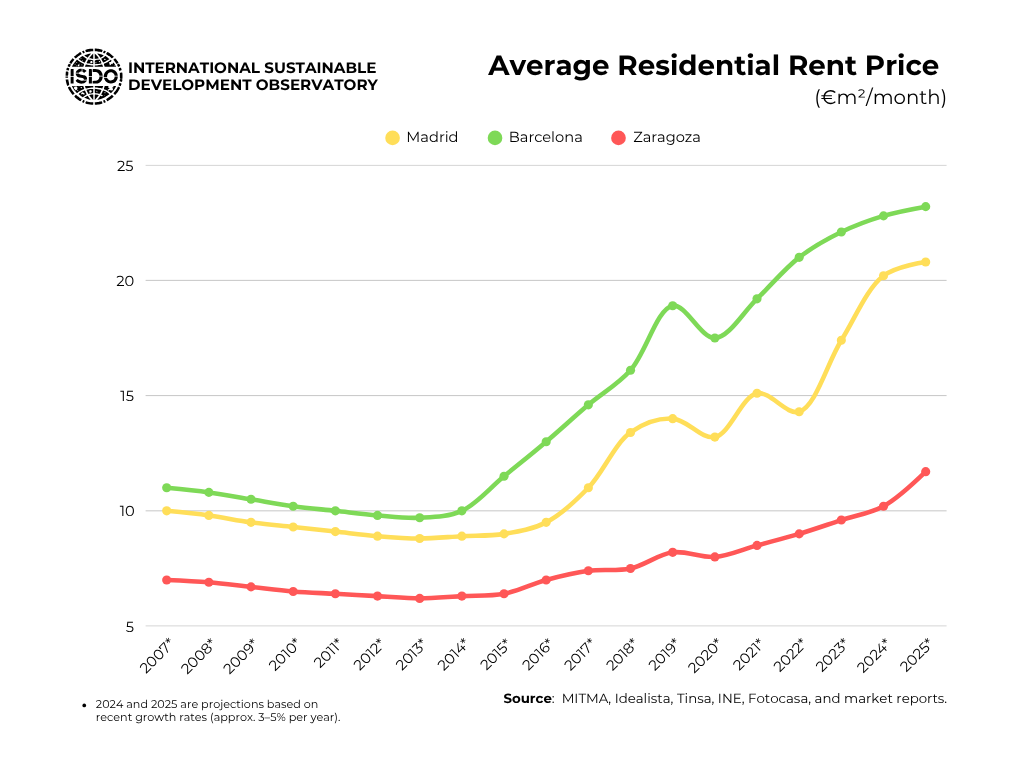

Legislative efforts, such as the 2023 Housing Law, aim to alleviate pressure by im- plementing rent controls in stressed areas. These measures include caps on annual rent increases, which are currently set at 2% for 2023 and will rise to 3% in 2024, alongside the introduction of a rental price reference index. However, despite these interventions, rental prices have climbed steadily, with major cities like Madrid and Barcelona seeing sharp increases. For instance, average rental prices in Madrid rose by over 15% last year, reaching record highs in many districts.

The Golden Visa program, previously a key driver of foreign investment in the real estate sector, is being phased out, with the real estate investment route officially ending in April 2025. While the scheme initially contributed to rising property prices and limited affordability for locals, its removal is expected to have minimal impact on the broader market. Critics argue that other macroeconomic factors, such as population growth and insufficient housing supply, play a far more substantial role in shaping market dynamics.

Foreign Investment

Comparative Analysis of Golden Visa Programs in Europe

Economic Impact on Housing Prices

The Golden Visa program, which allowed non-EU nationals to gain residency by purchasing property worth €500,000 or more, was formally eliminated in Spain on April 3, 2025. Despite concerns that such schemes were driving up housing prices, available data suggests that foreign investment through Golden Visas has had little to no impact on housing costs in Spain. This contrasts with other European countries like Greece and Portugal, where similar programs significantly influenced property markets. For instance, nearly 40% of Greece’s real estate investments came from Golden Visa applicants, contributing to a marked increase in property and rental prices in urban areas. Similarly, in Portugal, the program boosted the market, with a 60% surge in sales of properties priced at €500,000 or more.

While Golden Visa programs in countries such as Greece and Portugal are often blamed for inflating housing costs, their impact on Spain’s market appears to have been comparatively muted. This difference may stem from Spain’s broader real estate dynamics and the availability of other investment channels. However, crit- ics argue that the Golden Visa scheme altered community dynamics by transforming properties into short-term rental investments, thus exacerbating housing shortages in some areas. Although foreign buyers paid record prices for properties as the program ended, the long-term effects on Spain’s housing market remain uncertain.

The decision to phase out the program in Spain aligns with broader European concerns about the negative externalities of Golden Visas, such as enabling cor- ruption and overheating housing markets. However, Spain’s approach appears to prioritize mitigating these issues without fundamentally altering housing prices, unlike the more pronounced effects seen in neighboring countries.

Urban Housing Dynamics and Affordability Concerns

Housing affordability has emerged as a prominent issue in Spain, particularly in urban areas characterized by high demand and limited supply. Over the past decade, property prices per square meter in Spain have surged by more than 33%, significantly impacting affordability for local residents. The rising costs have sparked widespread protests, with activists targeting short-term rental platforms that are believed to exacerbate the housing crisis.

The Golden Visa program, which allowed non-EU foreigners to obtain residency by purchasing property worth 500,000 euros or more, has often been criticized forcontributing to housing shortages and increased property prices. While this scheme was a visible factor in the affordability crisis, macroeconomic elements such as constrained supply and broader demand patterns have played a much larger role in driving price increases. Between 2024 and 2025, rental prices and home values rose by 11%, further deepening the affordability issue.

On April 3, 2025, Spain formally removed the real estate investment option from the Golden Visa program, marking a shift in policy aimed at addressing housing concerns. Despite the termination of this scheme, experts believe its impact on the housing market was minimal, as the ban is expected to have as little influence as the program itself did. Provinces such as Barcelona, Madrid, Málaga, Alicante, the Balearic Islands, Girona, and others accounted for 93% of Golden Visa-related home purchases, underscoring the concentration of foreign investments in urban and coastal hotspots.

While the elimination of the Golden Visa program has been welcomed by some locals, who blame the influx of foreign investors for driving up housing costs, broader structural issues remain at the heart of Spain’s affordability crisis. These ongoing challenges highlight the need for comprehensive policy interventions to address housing dynamics in the country’s major urban centers.

Complementary Housing Policies: Affordable Housing and Rent Controls

In recent years, Spain has introduced measures to address housing affordability, including the implementation of rent control policies. A notable example is Catalunya’s adoption of rent freezes and a rental price index under new legislation that makes rent control possible nationwide. These policies aim to mitigate housing costs for tenants, a critical issue given Spain’s poor ranking among OECD countries in housing affordability metrics.

Studies have shown that rent control can reduce average rents paid by tenants by approximately 4% to 6%, providing relief to many households. However, the impact on housing supply has been contentious. Critics, including prominent economists, argue that rent control often leads to a reduction in the availability of rental properties. In Catalunya, for instance, the supply of long-term rental flats reportedly dropped by 15% following the enactment of rent control laws, while the short-term rental market experienced a sharp 60% increase. This shift under- scores potential unintended consequences, such as reduced housing availability for permanent residents and increased incentives for landlords to prioritize short-term rental platforms.

Additionally, suppressed market prices may contribute to a mismatch between supply and demand, as the development of new housing struggles to keep pace with growing needs. To address these challenges, Spain could consider complementary policies, such as incentivizing the construction of affordable housing and deregulation in Autonomic and local levels. These measures may help to stabilize the housing market while ensuring sufficient supply for both current and future residents.

Key Indicators

The Spanish real estate market from 2022 has been characterized by a significant mismatch between housing supply and demand, leading to escalating property prices and concerns over a potential housing crisis. Rental prices have risen dramat- ically over the past decade, with increases as high as 74% in major cities, further exacerbating affordability challenges. The introduction of the 2023 Housing Law seeks to address these issues, implementing rent control measures such as a cap on rental price increases of up to 3% per year, with additional provisions to regulate prices in stressed areas.

Catalunya has been at the forefront of these changes, implementing a rent freeze and a rental price index as part of the law. Furthermore, the new rental index, IRAV, has been designed to stabilize rental prices and limit year-on-year increases, though rental costs are still projected to rise by over 6% in 2023. For 2024, rental caps will rise to 3%, with a new Rent Index expected to be introduced in 2025 to refine regulation.

The market has also witnessed growing international interest, with foreign buyers acquiring over 88,000 properties in 2023, marking a record-breaking 45% increase compared to previous years. However, foreign direct investment (FDI) inflows into Spain declined by 20% year-on-year, totaling USD 35.9 billion, potentially reflecting broader economic challenges affecting the sector. These developments under- score the critical need for balanced policies to ensure affordability while maintaining market stability.

Rental Cost and Generational Disparities

The rising rental costs in Spain have had a disproportionate impact on low-income families and younger demographics, exacerbating existing inequalities in housing accessibility. A significant factor contributing to this issue is the mismatch between population growth and housing supply. While Spain’s population has been increasing by over 400,000 annually, fewer than 100,000 new homes are being constructed, leading to heightened demand and inflated housing prices. This shortage has made it increasingly challenging for low-income households to secure affordable housing, particularly as rental prices continue to climb breaking data not seen since 2008 rising by as much as 11% or more in high-demand areas.

Younger generations have been particularly affected by these dynamics, with the proportion of homeowners under the age of 35 dropping from 15% in 2002 to just 7% in 2022. Many young Spaniards are now delaying moving out of their family homes due to unaffordable housing options. Additionally, foreign-born populations and younger households are more likely to rent, further amplifying the demand in the rental market. Despite efforts to regulate rent increases, such as linking them to a 2% cap in 2023 and implementing rent control policies in regions like Catalunya, the financial strain persists for vulnerable groups and this control policies externalities seem to be higher than expected.

The widening gap between wage growth and housing costs has further entrenched inequality, with nearly half of private renters in the lowest income quintile spending a significant portion of their earnings on housing. This issue is compounded by broader economic trends, legislative shifts, and a resurgence in tourism, all of which have contributed to rising costs and displacement of residents. As a result, the lack of access to affordable rental housing remains a critical issue for Spain’s low-income families and younger demographics, deepening economic disparities and limiting upward mobility.

Percentage of Salary Spent on Housing Costs and Rent

| Country | % Salary for Total Housing Costs* | % Salary for Rent (Renters) |

|---|---|---|

| Spain | 32–36% | 38–41% |

| France | 27–31% | 33–36% |

| Portugal | 30–34% | 37–40% |

*Total housing costs include mortgage or rent, utilities, taxes, and other regular housing expenses.

The housing crisis in Spain has revealed significant generational disparities, particularly affecting young people who face unprecedented challenges in accessing affordable housing. Rising property costs have created an environment where young adults struggle to enter the housing market, with many experts emphasizing that this trend is unlikely to reverse without substantial policy changes. Among those living independently, the proportion of homeowners has sharply declined. Factors such as job insecurity and stagnant wages have further compounded the issue, pushing housing prices out of reach for younger generations.

This situation has triggered mass protests, with hundreds of thousands of citizens demanding more affordable housing options. Compared to other European nations, Spanish youth face notably higher barriers to accessing housing, with over 60% of individuals aged 18-34 still living with their parents. Spain also holds the fastest-growing rate of young people remaining in the family home, largely attributed to soaring property prices and delayed financial independence. The average age of emancipation in the country now exceeds 30 years, a figure significantly higher than in neighboring nations, highlighting the severity of the prob- lem.

Between 2014 and mid-2022, rental prices surged by 50%, far outpacing the 20% increase in housing sales during the same period. Meanwhile, average house prices have risen by 56% since 2014, well above the growth in real wages, further limiting the ability of younger generations to save for homeownership. As the affordability gap widens, generational disparities in housing access remain a critical challenge for Spain’s real estate market.

Regional Autonomy and Housing Policy Conflicts Regional Adaptation Strategies

Spain’s approach to housing policy must account for its distinctive administrative framework, which emphasizes regional autonomy alongside national objectives. The Spanish state and autonomous communities often encounter challenges in harmonizing their housing strategies due to these cultural and legal differences. This complexity is particularly pronounced in the context of adapting obligations akin to Mount Laurel doctrine, where balancing regional independence with overarching national housing goals becomes critical.

Moreover, the country’s housing market is under considerable strain, with a persistent imbalance between supply and demand that disproportionately affects major urban centers. This imbalance has exacerbated affordability issues, further complicating the implementation of cohesive housing policies across regions.

Scalability and InterRegional Coordination

Spain’s housing policies are shaped by its highly decentralized governance structure, which divides responsibilities among three levels of government: central, regional, and local. This decentralization enables regional governments to adapt housing strategies to their unique demographic and economic circumstances, allowing for tailored approaches to address issues such as affordability and housing short ages. However, this flexibility often results in fragmented strategies and weak inter-regional coordination, complicating efforts to scale effective solutions nationwide.

Affordability remains a critical issue in Spain’s housing market, exacerbated by a significant supply-demand imbalance in major urban centers. Only 2% of Spain’s housing stock is classified as affordable, far below the European Union average of 9.3%, and the country lags in public housing availability, with only 2.5% of its housing classified as public compared to 14% in France and 34% in the Netherlands. This deficit particularly impacts young people and families, who face increasing difficulties in accessing affordable rental options.

The decentralized system further complicates efforts to address these challenges through coordinated action across government levels. While regional adaptation is essential, the lack of standardized policies and scalable frameworks hampers long-term stability in the housing market. Effective coordination mechanisms, actionable policies, and incentives for affordable housing are necessary to mitigate disparities between regions and ensure cohesive nationwide strategies.

Opportunities for Tailored Housing Initiatives

Spain’s decentralized governance, comprising 17 autonomous communities, offers unique opportunities to address housing challenges through tailored initiatives that respond to regional needs. These communities hold jurisdiction over significant taxes like transfer tax, allowing them to directly influence housing policies and address the persistent supply-demand imbalance that particularly affects major urban centers and vulnerable populations, such as young people and socially excluded groups.

Despite the increasing regionalization of housing policies, research at sub-state lev- els remains scarce, highlighting the need for coordinated efforts across government levels to ensure long-term stability and affordability in the housing market. Autonomous communities have already taken steps to legislate on housing, guaranteed income, and social services, demonstrating their capacity to pioneer innovative housing initiatives that can bridge affordability gaps and improve equitable distribution across the country.

One promising model is Housing First, which emphasizes providing stable, inde- pendent housing without pre-requisite supports, an approach that could be adapted by regional governments to meet localized needs. Additionally, the recent promotion of affordable housing projects, including 14,266 dwellings developed in coordination with autonomous communities, showcases their ability to contribute significantly to addressing housing shortages. The completion of 14,371 VPO homes in 2024, marking a 62% increase from the previous year, further highlights the potential for regional governments to scale up efforts in providing affordable housing.

To maximize these opportunities, Spain must prioritize the development of alternative and innovative housing models, backed by political commitment at both national and regional levels, ensuring that autonomous communities play an active role in shaping the future of housing accessibility and affordability.

Cultural Considerations in Policy Implementation

Spain’s approach to housing policy is deeply influenced by its unique cultural and administrative frameworks, which differ significantly from other nations. For instance, while the Mount Laurel Doctrine in New Jersey requires municipalities to fulfill their “fair share” of affordable housing needs within a region, Spain must adapt similar obligations within the context of its decentralized governance structure. The country’s autonomous communities possess substantial legislative power over housing and social services, often creating divergence in regional strate- gies. For example, the Basque Country runs its own housing plans independently, while Catalunya has implemented rent control measures, including rent freezes and a rental price index.

Spain’s housing market faces structural challenges, including a historical policy bias favoring homeownership over rental and social housing. This, coupled with a supply-demand imbalance in urban centers, has exacerbated affordability issues. Attempts to legislate the right to housing in several autonomous communities post-2008 have faced legal challenges, underscoring the tension between regional autonomy and national housing objectives. Efforts to reconcile these disparities highlight the need for culturally sensitive solutions that address regional differences while promoting equitable housing access across the nation.

The Mount Laurel Doctrine’s emphasis on equitable housing distribution based on low- and moderate-income standards provides a useful reference for Spain. However, its implementation must account for Spain’s fragmented legal landscape and cultural nuances, ensuring regional autonomy is respected while aligning with broader national housing goals.

Potential Real Estate Bubble: Evidence and Perspectives

The Spanish real estate market in 2024-2025 presents striking parallels to the pre-crisis conditions of 2008, raising significant concerns about the formation of a new speculative bubble. This analysis examines the macroeconomic indicators, investor profiles, and market dynamics that suggest Spain may be experiencing a repeat of the conditions that precipitated the 2008 housing crisis, albeit with some notable differences in underlying fundamentals.

Macroeconomic Indicators: Echoing 2008 Patterns

Price Growth and Market Momentum

The Spanish housing market has entered an expansionary phase that mirrors the pre-2008 boom period. House prices increased by 11.16% year-over-year in Q1 2025, marking the highest growth rate since 2007. This acceleration is particularly concerning when compared to the price dynamics preceding the 2008 crisis, where similar double-digit growth rates characterized the market’s overheating phase.

The Bank of Spain has identified overvaluation in the housing market, estimating properties are overpriced by between 1.1% and 8.5% nationally. This overvaluation range has dramatically expanded from 0.8% to 4.8% just six months earlier, indicating rapidly deteriorating market fundamentals. Significantly, house prices in real terms at the end of 2024 were 11.5% above pre-COVID pandemic levels, reaching figures similar to those observed in 2004 during the previous bubble formation.

Transaction Volume and Market Activity

Property sales in Spain reached 642,000 homes in 2024, representing the third-highest figure in the historical series. The highest recorded figure was in 2007 at the peak of the real estate boom, while the second-highest occurred in 2022 post-pandemic. This pattern of transaction volumes approaching pre-crisis peaks suggests similar speculative behavior and market exuberance.

The final quarter of 2024 witnessed a particularly concerning surge, with housing demand increasing by 34.3% year-over-year. New home sales experienced the most significant growth, indicating renewed construction activity and speculative development similar to the 2008 bubble period.

Credit Market Conditions

Unlike the 2008 crisis, current lending standards remain relatively stable, with Spanish banks maintaining more conservative mortgage approval criteria. However, the European Central Bank’s monetary policy has created favorable financing conditions, with interest rates declining significantly from their 2023 peaks. The one-year Euribor, the primary reference rate for Spanish mortgages, has declined by 121 basis points compared to September 2023, reaching 2.936% in September 2024.

Despite tighter lending standards compared to 2008, mortgage origination in the first eight months of 2024 exceeded 2021 levels, indicating renewed credit expansion in the housing sector. This credit growth, while not reaching the reckless levels of the previous bubble, nonetheless represents a significant increase in leverage within the housing market.

Housing Supply-Demand Imbalance

Structural Supply Deficit

A critical factor driving current price increases is the severe housing supply shortage, with the Bank of Spain estimating a deficit of between 400,000 and 450,000 homes between 2022 and 2024. This imbalance is particularly acute in five key markets Alicante, Barcelona, Madrid, Málaga, and Valencia—which account for over 50% of the total deficit.

Housing Supply Deficit

Regional supply shortages drive price pressures

| Region | Estimated Deficit (2022-2024) |

|---|---|

| Madrid | 95,000 |

| Barcelona | 90,000 |

| Valencia | 65,000 |

| Málaga | 60,000 |

| Alicante | 55,000 |

| Other Regions | 85,000 |

| Total Spain | 450,000 |

The construction sector faces significant labor shortages, with only 9% of construction workers under 30 years of age compared to 25% in 2008. This demographic shift, combined with an aging workforce averaging 45.1 years compared to 37.3 years in 2007, constrains the sector’s ability to respond to demand pressures.

Geographic Concentration of Price Pressures

Price growth has been most pronounced in expensive regions, with the Balearic Islands experiencing 12.1% year-over-year increases and the Community of Madrid recording 9.4% growth in Q4 2024. This concentration in high-value markets mirrors the geographic patterns observed during the 2008 bubble, where coastal and major metropolitan areas experienced the most extreme price appreciation.

Tourist areas, particularly around the Mediterranean Coast and the Balearic and Canary Islands, have recorded monthly growth rates of 0.9% and 0.7% respectively, with year-over-year increases of 7.0% and 8.1%. For the first time since the crisis, the “Islands” group has exceeded the peak level reached in January 2008, indicating a return to bubble-era valuations.

Investor Profiles and Speculative Activity

Foreign Investment Surge

Foreign investment has reached unprecedented levels, with nearly 93,000 properties purchased by foreign buyers in 2024 the highest figure ever recorded. International buyers accounted for 14.6% of all property transactions, totaling over 636,000 nationwide sales. This foreign demand concentration is particularly intense in tourist regions, with the Balearic Islands seeing 32.6% of sales to foreign buyers, the Valencian Community 28.9%, and the Canary Islands 27.2%.

The dominance of British, German, and Moroccan buyers continues long-standing trends, but the scale of foreign investment now approaches levels that contributed to the 2008 bubble’s speculative nature. National investors still dominate overall investment activity, accounting for 57% of real estate investments totaling 5.5 billion euros in the first half of 2024.

Short-Term Rental Market Speculation

The proliferation of short-term rental platforms has created a new dimension of speculative activity absent during the 2008 bubble. Properties are increasingly purchased for conversion to tourist accommodations rather than long-term housing, directly reducing residential supply while inflating purchase prices.

Madrid alone has an estimated 14,000 short-term rental listings operating illegally, indicating the scale of speculative conversion activity. This phenomenon has prompted legislative responses, including new regulations requiring 60% neighbor approval for tourist rental conversions and mandatory registration systems effective July 2025.

The monetization potential of short-term rentals significantly exceeds traditional long-term rental yields, creating powerful incentives for speculative purchases. In prime tourist areas, rental yields can exceed 7.5% annually, with average nightly rates reaching €150 in top locations.

Short-Term Rental Market Impact

The emergence of tourist rental speculation adds a new bubble dimension

| City | Active Listings | Occupancy Rate (%) | Average Daily Rate (€) |

|---|---|---|---|

| Barcelona | 12,926 | 84% | €136 |

| Madrid | 14,000 | 78% | €120 |

| Malaga | 8,500 | 82% | €95 |

| Palma | 7,200 | 86% | €145 |

| Valencia | 6,800 | 75% | €85 |

Professional Investment Activity

The real estate investment landscape has become increasingly professionalized, with family offices and institutional investors showing particular interest in residential assets. Foreign capital specifically targets the residential sector, while family offices prefer tertiary assets including office and retail segments.

This institutional involvement mirrors patterns observed during the 2008 bubble, where professional investors and developers drove speculative construction and acquisition activity beyond levels sustainable by underlying housing demand.

Housing Affordability Crisis

Income-to-Price Ratios

The house price-to-income ratio has deteriorated significantly, with Spain’s index reaching 115.5 in Q2 2024, indicating housing costs have outpaced income growth by more than 15% since 2015. This affordability deterioration parallels the pre-2008 period when household leverage reached unsustainable levels.

Household debt service ratios remain relatively manageable at 5.3% in September 2024, near historical lows. However, this metric reflects current low interest rates rather than fundamental affordability improvements. The previous crisis peaked with debt service ratios reaching 11.6% in September 2008, providing a sobering comparison point.

Rental Market Pressures

Average rental costs have doubled over the past decade while salaries increased only 20%, creating severe affordability pressures. The central bank reports nearly 40% of rental families now spend more than 40% of their income on accommodation, approaching levels that historically precede financial distress.

This rental crisis has been exacerbated by the conversion of residential properties to short-term tourist accommodations, reducing long-term rental supply while increasing purchase prices through speculative demand.

Comparative Analysis with 2008 Bubble

Similarities to Pre-Crisis Conditions

Current market conditions exhibit several concerning parallels to the 2008 bubble period:

- Price Growth Rates: Double-digit price increases matching 2004-2007 patterns

- Transaction Volumes: Sales approaching historical peaks last seen in 2007

- Geographic Concentration: Price pressures concentrated in coastal and metropolitan areas

- Foreign Investment: International buyer activity at record levels

- Speculative Activity: Investment purchases for rental conversion rather than housing consumption

Key Differences from 2008

Several factors distinguish the current market from pre-2008 conditions:

- Lending Standards: Banks maintain more conservative mortgage approval criteria

- Leverage Levels: Household debt service ratios remain near historical lows

- Demographic Fundamentals: Strong inmigration growth support housing demand increase

- Supply Constraints: Current price increases reflect genuine supply shortages rather than pure speculation

Austrian School Economic Perspective

From an Austrian economics standpoint, the current Spanish housing market exhibits classic symptoms of an artificial boom driven by monetary policy distortions and regulatory interventions. The European Central Bank’s expansionary monetary policy has created artificially low interest rates, encouraging malinvestment in real estate assets beyond levels justified by genuine savings and time preferences.

The concentration of speculative activity in tourist accommodations and short-term rentals represents a misallocation of capital resources driven by regulatory arbitrage and monetary distortions rather than genuine consumer preference satisfaction. This malinvestment pattern typically leads to unsustainable boom-bust cycles characteristic of Austrian business cycle theory.

Conclusion

The Spanish real estate market in 2024-2025 demonstrates troubling similarities to pre-2008 bubble conditions, including rapid price appreciation, record transaction volumes, intense foreign speculation, and geographic concentration of price pressures. While current lending standards remain more conservative and household leverage appears manageable, the fundamental dynamics of supply-demand imbalance, speculative investment activity, and monetary policy distortions create conditions conducive to bubble formation.

The emergence of short-term rental speculation as a new vector for housing market distortion, combined with unprecedented foreign investment levels, suggests the current cycle may exceed the 2008 bubble’s speculative intensity despite more conservative banking practices. The Bank of Spain’s identification of property overvaluation ranging up to 8.5% nationally provides official recognition of developing bubble conditions.

From an Austrian economics perspective, these market distortions reflect fundamental misallocations of capital driven by monetary policy interventions and regulatory frameworks that encourage speculative rather than productive investment in housing assets. Without significant policy corrections to address supply constraints and speculative incentives, Spain risks repeating the painful adjustment process experienced following the 2008 crisis.

Supply-Demand Imbalance in Spain’s Housing Market: Structural Factors and Bureaucratic Constraints

The Spanish real state market supply-demand imbalance represents a complex structural problem rooted in multiple interconnected factors that extend far beyond simple market dynamics. While demand consistently outstrips supply—with only one new home built for every seven new households in 2022—the underlying causes reveal a multifaceted crisis involving bureaucratic overregulation, institutional fragmentation, labor market constraints, and systematic underinvestment in affordable housing. This analysis examines the primary factors contributing to Spain’s housing supply shortage, with particular attention to the role of regulatory bureaucracy as both a constraint and structural impediment to market equilibrium.

Bureaucratic Overregulation: The Primary Supply Constraint

Administrative Delays and Processing Times

Bureaucratic overregulation emerges as perhaps the most significant factor constraining housing supply in Spain. Industry professionals report that developers “spend more time obtaining permits to build a home than actually building it,” with the permit acquisition process taking up to two years, followed by an additional year for completion certificates after a two-year construction period. This means that 60% of the total development timeline—approximately three years out of five—is consumed by administrative procedures rather than actual construction.

Municipal planning departments demonstrate severe processing inefficiencies, with building permits taking an average of 186 days to be granted when the legal maximum should be 90 days for major works. In some municipalities like Majadahonda, planning permission delays extend to 16 months, adding €39,000 to the cost of new homes—representing approximately 11% of total project costs. Across Spain, the average delay of 12 months adds €13,000 per home to development costs, which developers inevitably pass on to buyers.

Building Permit Processing Timeline Data

The most striking evidence of bureaucratic overregulation comes from permit processing delays across Spanish municipalities:

| Municipality | Processing Time (Months) | Legal Maximum | Delay Factor | Added Cost per Home |

|---|---|---|---|---|

| Majadahonda (Madrid) | 16 | 3 | 5.3x | €39,000 |

| Málaga | 6.2 | 3 | 2.1x | €13,000 |

| National Average | 12 | 3 | 4.0x | €13,000 |

| Barcelona | 8-10 | 3 | 2.7-3.3x | €15,000-20,000 |

Regulatory Complexity and Legal Uncertainty

The Spanish regulatory framework creates “Kafkaesque situations” for architects and developers due to contradictory regulations that accumulate without eliminating outdated requirements. Housing legislation has undergone significant changes that destabilize development plans, introducing legal uncertainty, reducing profitability, and discouraging economies of scale. Many municipal permit departments are headed by lawyers rather than architects, precisely the councils experiencing the most significant delays.

Environmental impact assessments (EIAs) compound these delays, with the current average processing time reaching 770 days despite government efforts to reduce this to six months. The regulatory complexity varies dramatically across Spain’s 17 autonomous communities, each with different environmental assessment procedures, documentation requirements, and administrative approaches. This fragmentation creates additional compliance burdens for developers operating across multiple regions.

Land Classification and Urban Planning Constraints

Spain’s tripartite land classification system creates fundamental supply constraints through restrictive zoning policies. Land is classified as suelo urbano (urban land with full infrastructure), suelo urbanizable (developable land requiring infrastructure development), or suelo rústico (protected rural land with severe construction restrictions). While cities possess land suitable for housing development, the proportion of “finalized land” ready for immediate construction remains severely limited.

The urban development process involves extensive legal complexity, with projects requiring approval of partial plans (Plan Parcial) and urbanization projects (Proyecto de Urbanización) before construction can commence. Spain has pending construction equivalent to 26% of its current residential stock, indicating substantial land reserves constrained by regulatory rather than physical limitations.

Institutional Fragmentation and Coordination Failures

Decentralized Housing Competencies

Spain’s decentralized institutional structure creates significant coordination challenges in housing policy implementation. The 1978 Constitution grants exclusive housing competencies to the 17 autonomous communities, while central government lacks legislative authority in urban planning matters. This fragmentation means housing policies must be approved by all autonomous communities or require constitutional amendments—both extremely difficult prospects.

Municipal governments control urban planning, permit issuance, and initial inspections, while regional governments establish variations of national building codes. This three-tier system (national, regional, municipal) creates overlapping jurisdictions and coordination failures that impede coherent housing supply responses. Regional rivalry between departments within the same autonomous community further complicates policy implementation.

Administrative Capacity Constraints

Many municipalities lack sufficient administrative capacity to process applications efficiently. The quality service analysis in Málaga revealed systematic delays doubling legal processing times, attributed to insufficient staffing and inadequate technical expertise in licensing departments. Citizens report concerns about “lack of efficiency, transparency and diligence in administrative processes,” contributing to economic development delays.

Labor Market Constraints and Skills Shortages

Demographic Challenges in Construction

Spain’s construction sector faces severe demographic constraints that limit supply responses. The construction workforce has aged dramatically, with only 9% of workers under 30 years compared to 25% in 2008. The average age increased from 37.3 years in 2007 to 45.1 years in 2024, creating impending retirement waves without adequate replacement.

The sector requires more than 700,000 additional professionals, including bricklayers, electricians, plumbers, and carpenters. Almost half of Europe’s construction skill shortages are concentrated in Spain, with essential trades becoming increasingly scarce. The specialization of construction tasks has multiplied personnel requirements, as workers who previously performed multiple functions now specialize in narrow areas.

Productivity Decline

Construction sector productivity has declined precipitously, falling more than 20% since 2013 when measured as gross value added per hour worked. Current productivity levels approximate those from 20 years ago, closer to 2007 lows than 1995 highs. This productivity decline, combined with worker shortages, constrains the sector’s ability to respond to demand pressures even when regulatory approvals are obtained.

The educational profile of construction workers remains problematic, with nearly 70% lacking high school education—a percentage unchanged over 15 years. This skills deficit limits the sector’s capacity for technological adoption and efficiency improvements that might offset demographic constraints.

Material Costs and Supply Chain Disruptions

Construction Cost Inflation

Construction material costs have increased significantly since 2021, initially driven by post-pandemic demand recovery and subsequently exacerbated by the Ukraine war. Industrial metals prices rose 53% between January 2021 and April 2022, with current levels remaining 28% above pre-pandemic baselines. Building materials including glass, aluminum, and timber have increased up to 40% in some cases.

These cost increases reduce developer profitability and discourage new construction starts. The combination of higher material costs with extended regulatory delays creates compounding financial pressures that make many projects economically unviable. Transport costs have also surged due to oil price increases, affecting material delivery and overall project expenses.

Inadequate Public Housing Investment

Social Housing Deficit

Spain maintains one of Europe’s lowest social housing stocks, representing only 2.5% of total housing compared to the EU average of 9.3%. Countries like the Netherlands (30%), Austria (24%), and Denmark (20%) demonstrate significantly higher public housing provision. This deficit forces low-income households into private markets, increasing demand pressures on already constrained supply.

Spain’s protected housing was historically designed for controlled-price sales rather than long-term public rental, with properties reverting to market prices once protection periods expired. This approach failed to build permanent affordable housing stock, unlike European models emphasizing perpetual public ownership.

Financing and Institutional Capacity

The Spanish housing system lacks the institutional capacity and financing mechanisms that enable other European countries to maintain substantial public housing stocks. Unlike Vienna’s strategic land management or the Netherlands’ social housing financing model, Spain has not developed systematic approaches to affordable housing provision. The 2023 Housing Act sets targets to increase social housing stock by 20% in stressed areas over 20 years, but implementation remains challenging given current institutional constraints.

Regional Variations and Geographic Concentration

Geographic Supply Constraints

Housing supply deficits concentrate in five key markets—Alicante, Barcelona, Madrid, Málaga, and Valencia—accounting for over 50% of the estimated 450,000-home shortage between 2022 and 2024. These regions experience the most acute regulatory delays, highest construction costs, and greatest demand pressures.

Tourist areas demonstrate particular supply-demand imbalances, with short-term rental conversions removing properties from long-term residential markets. The Balearic Islands, Valencia, and Canary Islands show monthly price growth rates exceeding 0.7%, with annual increases surpassing 7-8%. Foreign investment concentrates in these regions, with international buyers comprising 32.6% of sales in the Balearics and 28.9% in Valencia.

Systemic Market Distortions

Speculation and Investment Patterns

The emergence of short-term rental markets creates systematic distortions in housing supply allocation. Properties purchased for tourist accommodation conversion rather than residential use directly reduce available housing stock while inflating purchase prices through speculative demand. Madrid alone has an estimated 14,000 illegal short-term rental listings, indicating the scale of supply diversion.

Professional investors and family offices increasingly target residential assets, with foreign capital showing particular preference for residential over commercial properties. This institutional involvement mirrors patterns from the 2008 bubble, where professional speculation drove acquisition activity beyond levels sustainable by underlying housing demand.

Conclusion

Spain’s housing supply-demand imbalance results from a complex interaction of structural factors, with bureaucratic overregulation serving as the primary constraint on supply responsiveness. The combination of administrative delays, regulatory complexity, institutional fragmentation, labor shortages, and inadequate public investment creates systematic barriers to adequate housing provision.

From an Austrian economics perspective, these supply constraints represent classic examples of regulatory-induced market failures, where administrative interventions prevent price signals from coordinating supply and demand efficiently. The bureaucratic apparatus designed to ensure orderly development has become the principal impediment to meeting housing needs, creating artificial scarcity that benefits existing property owners while imposing substantial costs on new household formation.

Addressing Spain’s housing crisis requires fundamental regulatory reform to streamline approval processes, improve inter-governmental coordination, invest in administrative capacity, and develop systematic approaches to affordable housing provision. Without such reforms, the supply-demand imbalance will continue generating bubble-like conditions regardless of monetary policy or demand-side interventions.

References

Spain’s Residential Property Market Analysis 2025 – Global Property Guide

https://www.globalpropertyguide.com/europe/spain/price-history

The Spanish housing market – Banco de España (April 2024 presentation)

https://www.bde.es/f/webbe/GAP/Secciones/SalaPrensa/IntervencionesPublicas/Gobernador/Arc/Fic/IIPP-2024-04-29-hdc-en-tr.pdf

The Spanish housing market: recent changes, risks and affordability problems – Banco de España, Annual Report 2023

https://www.bde.es/f/webbe/SES/Secciones/Publicaciones/PublicacionesAnuales/InformesAnuales/23/Files/InfAnual_2023_Cap4_En.pdf

Spanish Housing Market Report Q3-2024: House Prices since 2023 – Nardia

https://www.nardia.es/news/article/42/spanish-housing-market-report-q3-2024-house-prices-since-2023-1156-sales-1887

22 trends & predictions for the Spanish real estate market in 2025 – Cottage Properties

https://www.cottageproperties.es/en/blog/spanish-real-estate-market-trends-predictions

The Spanish real estate market in 2024-2025: in expansive mode – CaixaBank Research

https://www.caixabankresearch.com/en/sectoral-analysis/real-estate/spanish-real-estate-market-2024-2025-expansive-mode

Banco de España, Financial Stability Report, Spring 2025 edition.

https://es.ara.cat/economia/inmobiliario/banco-espana-detecta-incremento-sobrevaloracion-precio-vivienda_1_5393242.html

English summary: “The Bank of Spain detects overvaluation of housing prices,” May 2025.

https://en.ara.cat/economy/the-bank-of-spain-detects-an-increase-in-the-overvaluation-of-housing-prices_1_5393244.html

Banco de España Working Paper No. 2244 (2022) on house price misalignment models:

https://www.bde.es/f/webbde/SES/Secciones/Publicaciones/PublicacionesSeriadas/DocumentosTrabajo/22/Files/dt2244e.pdf

Huerta de Soto, Jesús. The Theory of Dynamic Efficiency.

https://www.routledge.com/The-Theory-of-Dynamic-Efficiency/HuertaDeSoto/p/book/9780415759731

Huerta de Soto, Jesús. Money, Bank Credit, and Economic Cycles.

https://mises.org/library/book/money-bank-credit-and-economic-cycles

Huerta de Soto, Jesús. Socialism, Economic Calculation and Entrepreneurship.

Huerta de Soto, Jesús. The Austrian School: Market Order and Entrepreneurial Creativity.

https://www.e-elgar.com/shop/gbp/the-austrian-school-9781847207692.html

Offical Institutions Referenced

Instituto Nacional de Estadística (INE) – Spanish National Statistics Institute

- Main source for housing prices, transaction volumes, population and household formation, and construction data.

https://www.ine.es/en/

Banco de España – Bank of Spain

- Official monetary authority. Source for house price indices, mortgage credit, household debt, and overvaluation estimates.

https://www.bde.es/bde/en/ - Financial Stability Report, Spring 2025 (overvaluation):

https://en.ara.cat/economy/the-bank-of-spain-detects-an-increase-in-the-overvaluation-of-housing-prices_1_5393244.html

Ministerio de Vivienda y Agenda Urbana – Ministry of Housing and Urban Agenda

- Official data on building permits, housing starts, completions, and public housing stock.

https://www.mivau.gob.es/

Eurostat – Statistical Office of the European Union

- Comparative house price index data, European social housing comparisons.

https://ec.europa.eu/eurostat

Consejo General del Notariado

- Official registry of property transactions and market activity.

https://www.notariado.org/

Colegio de Registradores de España

- Official property registry data, including price per square meter and regional breakdowns.

https://www.registradores.org/

CaixaBank Research – Sectoral Analysis

- Sector reports on housing market cycles, supply-demand imbalances, and forecasts.

https://www.caixabankresearch.com/en/sectoral-analysis/real-estate/spanish-real-estate-market-2024-2025-expansive-mode

Idealista – Market Data Portal

- Data on average prices, rental yields, and regional market trends.

https://www.idealista.com/en/news/

Urbanitae – Housing Transaction Analysis (using INE data)

- Analysis of annual and monthly transaction volumes, new-build vs. second-hand sales.

https://blog.urbanitae.com/en/2025/02/25/housing-transactions-close-2024-with-a-10-increase-ine-analysis-and-2025-outlook/

Global Property Guide – Spain’s Residential Property Market Analysis 2025

- Comparative price growth, rental yields, and international context.

https://www.globalpropertyguide.com/europe/spain/price-history

Cottage Properties – Spanish Real Estate Market Trends & Predictions

- Aggregated official statistics and forecasts for 2025.

https://www.cottageproperties.es/en/blog/spanish-real-estate-market-trends-predictions

Trading Economics / Eurostat – House Price Index

- Time series and historical comparison of house price indices.

https://tradingeconomics.com/spain/house-price-idx-eurostat-data.html

doi:10.7910/DVN/GVMSHO