Please download the PDF below to access the full report:

This report’s primary objective is to examine the market situation of electric vehicles in China and the EU. It will analyze the sanctions imposed by the European Authorities on this industry and Chinese manufacturers. It will also compare the production models of European and Chinese manufacturers. Furthermore, it will examine how sanctions will affect markets and customers. Finally, it will draw conclusions and recommendations.

The global electric vehicle (EV) market has experienced a period of accelerated growth in recent years, driven by a confluence of factors including mounting environmental concerns, government incentives, and technological advancements. However, the relationship between the European Union (EU) and China, two of the largest EV markets, has become strained due to trade disputes and the imposition of sanctions by the EU on Chinese EV manufacturers.

Other objective of this report is to provide a comprehensive analysis of the impact of EU sanctions on the market. This will entail an examination of the market dynamics, production models, and competitive landscape of both European and Chinese EV manufacturers, as well as a detailed analysis of the specific sanctions imposed by the EU and their consequences.

The European Union (EU) has implemented a series of sanctions targeting Chinese electric vehicle (EV) manufacturers. These sanctions include tariffs of up to 38,1% on select models and non-tariff barriers such as more rigorous certification requirements and technical regulations. These measures were supposedly designed to safeguard the European EV industry and ensure fair competition.

Additionally, European and Chinese EV manufacturers have adopted disparate production models. European manufacturers prioritize premium and luxury models, while Chinese manufacturers focus on mass-market and affordable models. This distinction has implications for their competitiveness and ability to navigate the current trade environment.

The EU sanctions on Chinese EV manufacturers have had a significant impact on both markets. This includes a reduction in market share for Chinese EV manufacturers in the EU, as well as supply chain disruptions, increased costs, and losses of innovation and synergies for the EU.

Methodology:

The methodology of the report is based on a comprehensive approach that includes a thorough review of existing publications and information on the EU-China “trade dispute” in the electric vehicle (EV) sector, as well as the collection of relevant data on sales, production and market shares and other relevant economic data.

As a contrast between macro and micro data, case study analyses of manufacturers will be carried out in order to gain qualitative insights. In addition, data analysis will be performed to compare patterns and trends.

Finally, conclusions and recommendations will be drawn based on the findings, with the aim of providing a clear view on the impact of EU sanctions on the electric vehicle industry.

Analysis of the Differences in the Tax Treatment of EV:

The primary point of contention regarding the recently imposed EU sanctions on the import of Chinese electric vehicles pertains to the alleged subsidies and overcapacity of the Chinese industry in this market. European authorities have issued statements in official communications asserting that the battery electric vehicles (BEV) value chain in China is subject to unfair subsidization.

The objective of this section is to analyze the main peculiarities in the tax and subsidy treatment between the EU and China. This analysis will clarify the strategies and demonstrate, through quantitative analysis, whether there are differences and, if so, which parties would potentially benefit from them.

The Chinese EV tax market:

In China, the government has adopted a proactive approach to encourage the adoption of electric vehicles (EVs) through the implementation of significant tax incentives. For instance, EV purchasers are eligible to receive subsidies ranging to $3,800 (According to data from 2022), contingent upon battery capacity and vehicle model. Furthermore, according to local authorities and the IEA Global EV Outlook 2023 report, EVs are exempt from vehicle purchase tax and road tax, which markedly reduces the overall cost of acquisition for consumers.

The EU EV tax market:

In contrast to China, where subsidies for the purchase of electric vehicles are fairly uniform at the national level, subsidies in the EU vary widely from country to country:

- Germany: Offers subsidies of up to 9,000 euros for the purchase of new electric vehicles (subsidy eliminated in 2024).

- France: Offers a 6,000 euro incentive for the purchase of electric cars costing less than 47,000 euros

- Spain: It has the MOVES III plan, which includes subsidies of 4,500 to 7,000 euros for the purchase of electric vehicles.

In addition to subsidies, electric vehicles also enjoy certain tax benefits in the EU:

- Registration tax exemptions or reductions: Several countries, such as Germany, France and Spain, offer exemptions or discounts on this tax to encourage the purchase of electric vehicles.

- Vehicle tax rebates: Some countries, such as Norway and the Netherlands, have introduced annual tax benefits for EV owners.

- Reduced VAT: Some countries apply a reduced VAT rate to the purchase of electric vehicles, such as Ireland (13.5%), Luxembourg (8%) and Portugal (13%).

- Portugal has become a case study in the implementation of incentives for the purchase of electric vehicles (EVs), with the introduction of measures allowing buyers to deduct the full value-added tax (VAT) related to electricity from recharging. This makes these measures particularly attractive, as they provide immediate financial benefits to individuals who wish to purchase these cars. Furthermore, the subsidies for the purchase of electric vehicles are received without any waiting periods. It should be noted that electric cars in Portugal do not pay registration tax either.

Conclusions on the differences:

It is noteworthy that an analysis of the total amounts applied as subsidies reveals a significant discrepancy between the approaches of the EU countries and China. While the former tend to directly subsidize purchases, the latter rely on tax reductions and exemptions, which can potentially offer significant advantages in terms of competitiveness and economic efficiency. By reducing upfront costs, these measures help to contain price increases throughout the value and production chain, thereby exerting a multiplier effect on efficiency of processes. This not only increases the adoption of electric vehicles but also strengthens the industry capabilities and R&D.

The discrepancy in methodologies appears to be the primary rationale behind the allegations made by certain European lobbyists. If the EU were to implement a similar approach to that of China, it would be production capacity, rather than state interventions in the market, that would determine the quantity and price at which goods could be sold, while maintaining a consistent level of quality.

The “Portuguese case” may serve as an illustrative example of differentiation within the EU, demonstrating the potential advantages of direct subsidies (similar to the measures implemented by the Chinese authorities) without the burden of extensive bureaucracy and prolonged waiting periods. Such an approach could facilitate the adoption of EVs by reducing the initial cost barrier and fostering the market’s acceptance.

This case is particularly illustrative, as Business Insider reports that “Portuguese companies purchased 88% of electric vehicles.” This has also facilitated the establishment of more extensive charging networks. It is evident that the adoption of electric vehicles is not solely attributable to tax incentives, but also to their comparative efficiency in terms of consumption and cost per kilometer traveled when compared to internal combustion vehicles, especially when their acquisition is encouraged and facilitated in a simple way.

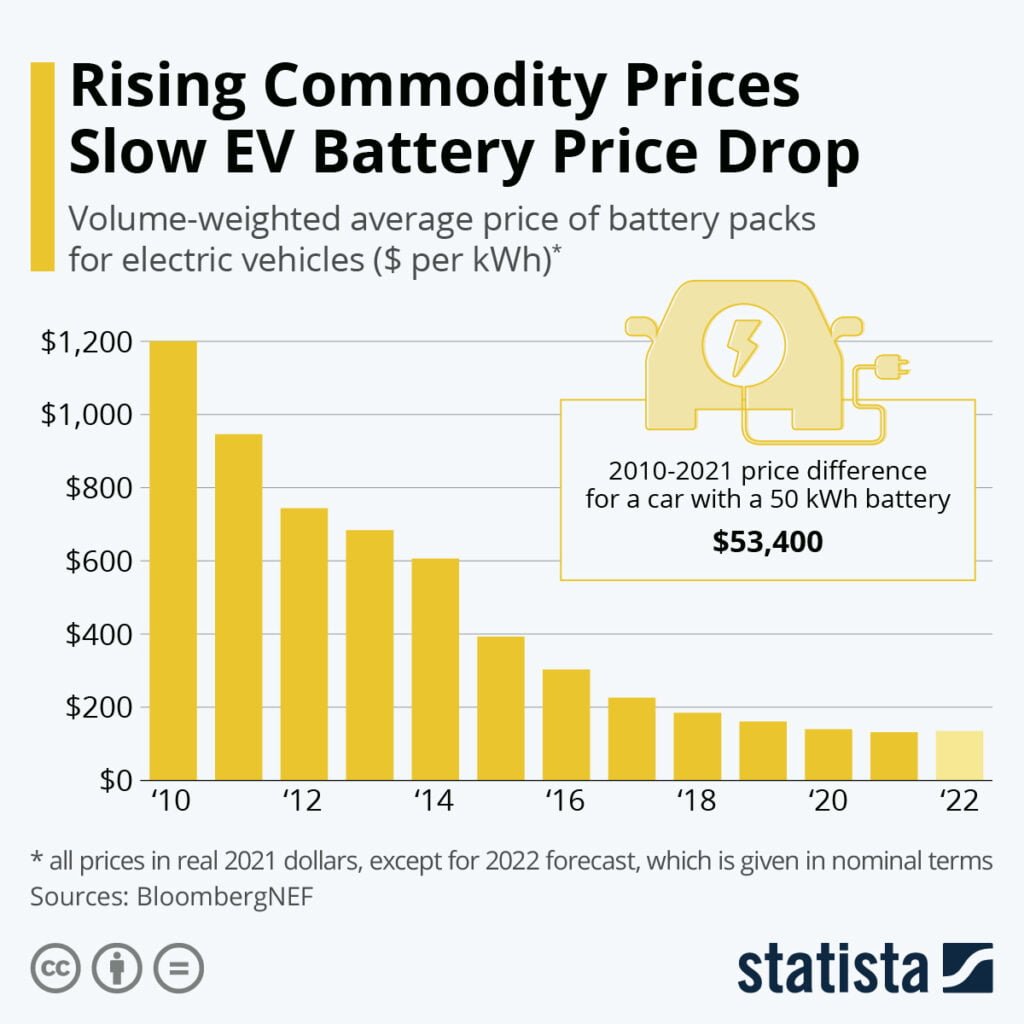

The fact that companies are the first to adopt new technologies has the additional benefit of accelerating the pace of innovation. Those economic agents with greater “purchasing power” are the first to invest in technologies in their initial stages due to the additional returns and advantages that these technologies offer them. Over time, these innovations become more affordable for the general public as production scales up (Economies of scale) and improvements drive down costs.

This proposition is also supported by theories related to “behavioral economics.” Tax reductions may be a more effective means of influencing consumer behavior. Individuals often respond more favorably to the prospect of retaining a greater proportion of their income (through tax cuts) than to receiving government handouts, which may be perceived as less stable or reliable.

How the new sanctions affect Evs:

As indicated by EU authorities, The final decision on the European Union’s tariffs on Chinese electric vehicles is expected at some point in November 2024. These tariffs were initially imposed as provisional measures in response to what the EU perceives as unfair subsidies provided by the Chinese government to its electric vehicle manufacturers. The tariffs range from 17.4% to 38.1%, contingent upon the degree of “cooperation” exhibited by the manufacturers during the EU’s investigation. The provisional tariffs are set to become definitive unless a resolution is reached. The EU member states are expected to vote on the permanent tariff proposals in late October 2024, which would then be applied in November 2024 if approved.

The European Union has imposed provisional tariffs on Chinese electric vehicles, with the rates varying by manufacturer. Here is the breakdown of the tariffs by brand:

- BYD: 17.4%

- Geely: 19.9%

- SAIC: 37.6%

These tariffs are in addition to an existing 10% duty on all Chinese electric cars imported into the EU.

How can these measures affect prices?:

Tariffs imposed by the European Union on electric vehicles (EVs) imported from China will have a considerable impact on consumer pricing for these vehicles. The implementation of these tariffs has the potential to elevate the financial burden associated with cost-effective alternatives, simultaneously compromising the accuracy of genuine price-based competition.

The supplementary tariffs, which can reach up to 38.1%, will markedly elevate the expense associated with Chinese electric vehicles. This will consequently result in elevated prices for end consumers. To illustrate, an electric vehicle with an initial price tag of 30,000 could experience an increase of up to 11,430 if the maximum tariff is applied.

| Vehicle | Price Before (€) | Price After (€) |

BYD Seal | 45,000 | 51,425 |

Tesla Model 3 (no EU) | 41,000 | 44,690 |

VW ID.4 | 45000 | 45,000 |

Ford Mustang Mach-E | 48,000 | 48,000 |

Xiaomi SU7 (Estimated) | 41,500 | 54,477 |

VW ID.3 | 36,580 | 36,580 |

MG 4 | 30,690 | 40,190 |

Dacia Spring | 19,100 | 19,100 |

BYD Dolphin | 29,000 | 32,544 |

A reduction in the number of affordable options:

Chinese electric vehicles, such as models from MG and BYD, have constituted a popular choice among consumers due to their affordability. As a result of the new tariffs, consumers seeking competitively priced electric vehicles will have a reduced range of interesting options.

This could result in a reduction in the rate of adoption of electric vehicles, something that is already happening in Europe according to reports from the SEAI and Goldman Sachs Research, falling below 20% for the EU average , as consumers may opt for more cost-effective internal combustion vehicles or choose not to replace their current vehicle.

The distortion of real market competition:

The tariffs have the potential to distort competition by making European electric vehicles appear more price-competitive, not as a result of improvements in production efficiency or innovation, but due to the imposition of tariff barriers

This could diminish the incentive for European manufacturers to innovate and reduce costs, as the competitive pressure from Chinese electric vehicles would be artificially constrained. By limiting competition from Chinese electric vehicles, European manufacturers may have less motivation to enhance production efficiency and lower prices

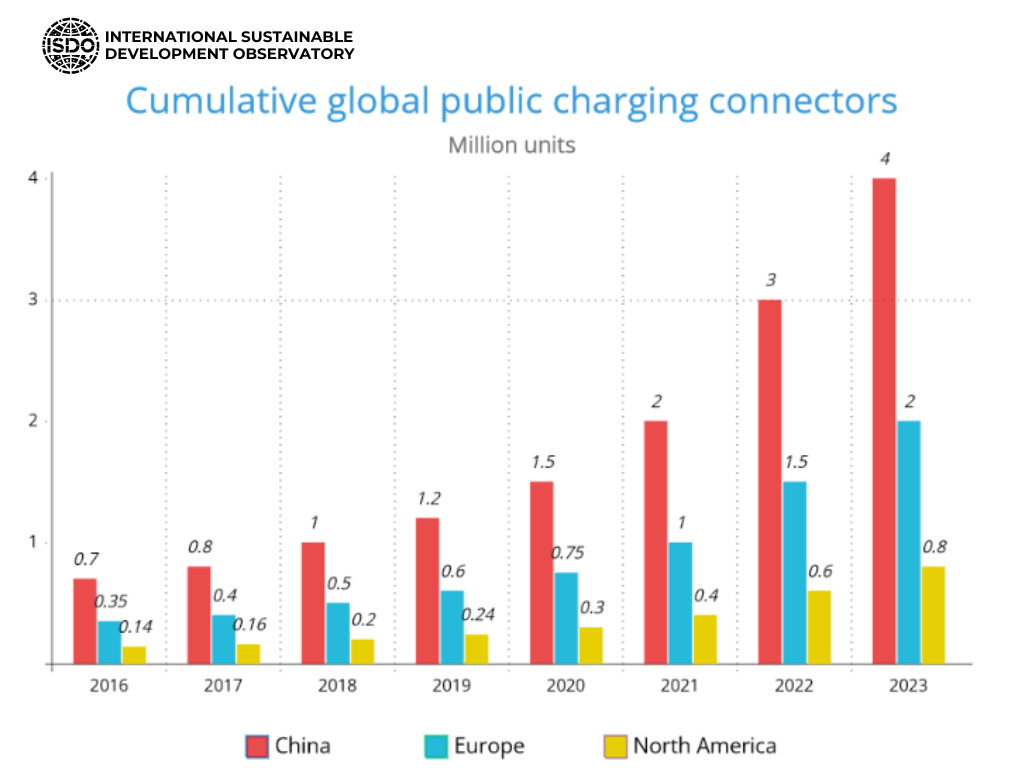

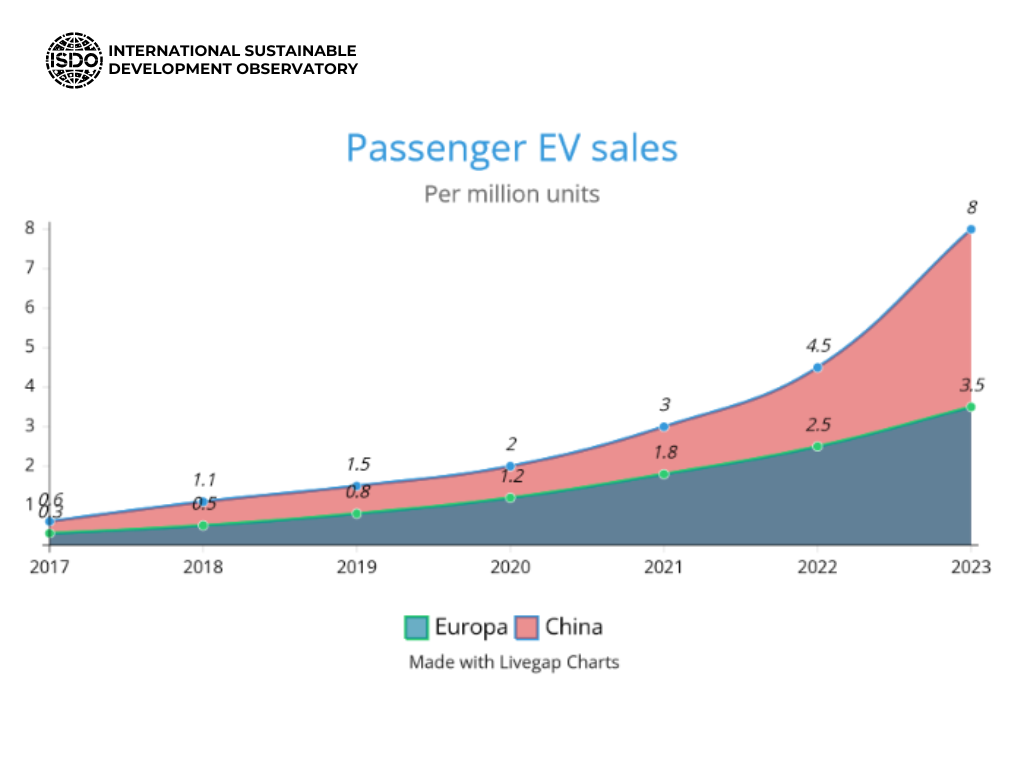

Other production and raw materials access related factors may also be enhancing the effect of economies of scale in the Chinese EV production. While Europe is dependent on third parties for processing, data recently published by the United Nations Conference on Trade and Development (UNCTAD) shows that China accounts for around two-thirds of the world’s processing/refining capacity for critical minerals. This would have a significant impact on the reduction of costs associated with accessing these materials, which are essential for the production of electric vehicles and, consequently, for enhancing competitiveness. It is important to note, however, that this is not a strategic advantage exclusive to China, as there are deposits of these same raw materials on European soil. Furthermore, the recycling of these materials and the technological development curve facilitate access to them, which is not an insurmountable competitive advantage in medium term.

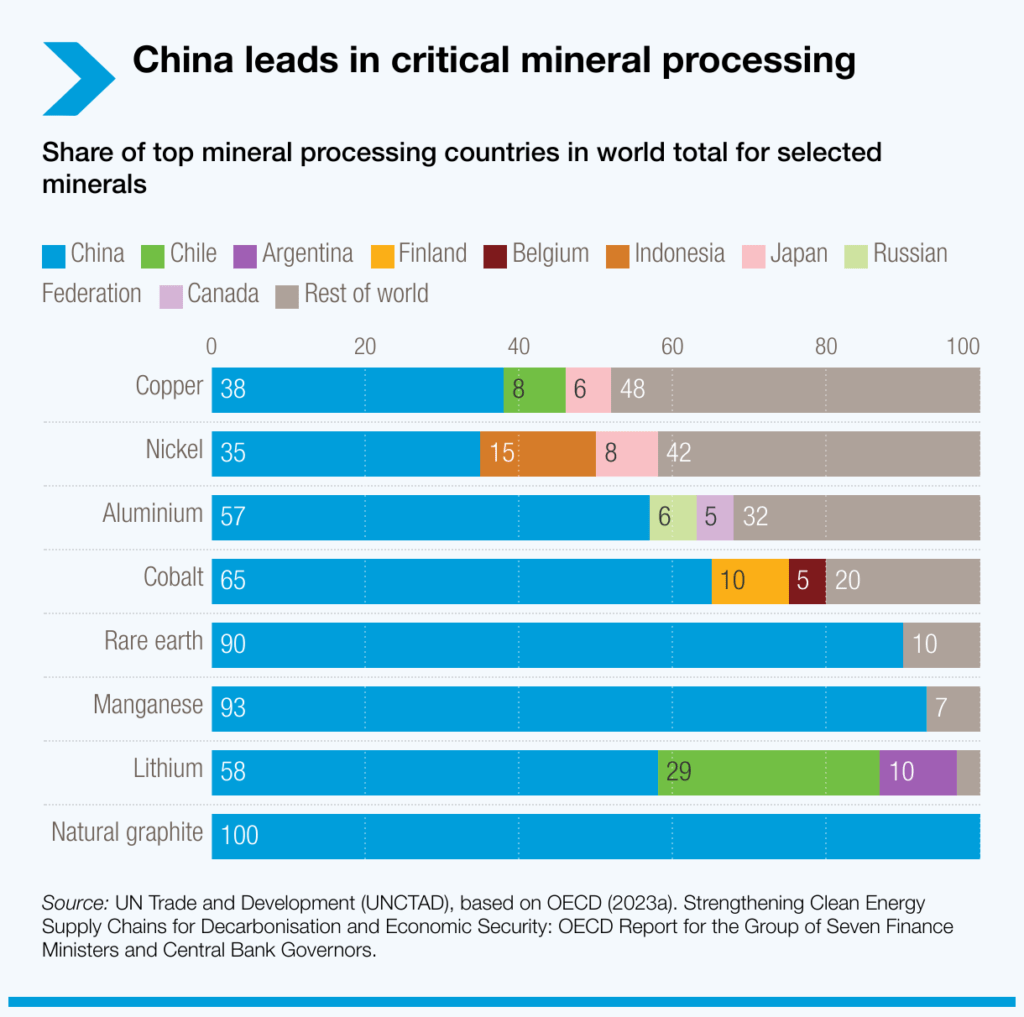

In terms of sales, both markets demonstrate notable discrepancies in consumer behavior toward electric vehicles. As reported by the European press, electric vehicle sales in the European Union experienced a 5% decline in 2024, indicating a deceleration in the rate of adoption. This can be attributed to a number of factors, including elevated prices and unmet expectations, with only 20% of Europeans owning electric or plug-in vehicles. Additionally, the economic climate, high production costs, and brands’ adjustments to their EV strategies, such as Audi and Mercedes, are supposed to have contributed to this decline.

On the other hand, From January to June 2024, the production and sales of new energy vehicles in China reached 4.929 million and 4.944 million, respectively, representing a 30.1% and 32% increase, respectively, compared to the same period in the previous year. By the end of June, the market share of new energy vehicles reached 35.2%. Additionally, acumulative sales of new energy vehicles exceeded 30 million units by June.

Report Conclusions:

The European Union’s decision to impose tariffs of up to 38% on Chinese electric vehicles (EVs) is a short-sighted measure that may ultimately hinder rather than help the EU’s automotive industry and green transition goals. This protectionist approach carries significant risks and limitations:

Easily Circumvented: Chinese manufacturers can readily avoid these tariffs by establishing production facilities within the EU. Companies like BYD and Geely are already planning European factories, which will allow them to continue selling competitively priced EVs in the European market. This loophole undermines the tariffs’ intended effect of protecting EU manufacturers.

Stifling Innovation: By artificially inflating prices of Chinese EVs, the EU risks reducing competitive pressure on domestic manufacturers. This could lead to complacency and slower innovation in the European automotive sector, potentially widening the technological gap between EU and Chinese EV producers.

Slowing EV Adoption: Higher prices resulting from these tariffs may slow down EV adoption rates among price-sensitive consumers, contradicting the EU’s ambitious climate goals and green transition plans.

Retaliation Risks: These tariffs could provoke retaliatory measures from China, potentially harming European companies with significant operations in the Chinese market, such as Volkswagen and BMW.

Supply Chain Disruptions: The global EV supply chain is deeply interconnected. Tariffs may disrupt established supply networks, leading to inefficiencies and increased costs for European manufacturers relying on Chinese components.

Consumer Impact: European consumers will likely face higher prices and reduced choices in the EV market, which could slow down the transition from internal combustion engines to electric vehicles.

The alternative fuel with no environmental impact: Despite the efforts of some EU manufacturers to promote the widespread adoption of biofuels with minimal environmental impact, concerns have been raised about the potential adverse effects of this approach. Various NGOs have cautioned about the potential drawbacks of this strategy for the automotive industry, as well as its possible implications for the agricultural sector and the production of specific grains and cereals.

Long-term Competitiveness: Shielding EU manufacturers from Chinese competition may reduce their incentives to improve efficiency and innovate, potentially weakening their long-term global competitiveness.

In conclusion, while the EU’s objective is to safeguard its domestic electric vehicle (EV) industry, these tariffs may prove to be counterproductive. The ease with which these tariffs can be circumvented through local production demonstrates their limited effectiveness. Furthermore, this protectionist approach may ultimately impede the very innovation and progress it seeks to foster. Historically, free and fair competition in markets has been the most effective driver of innovation and efficiency. Rather than erecting trade barriers, the EU should focus on creating a supportive ecosystem for EV development and adoption. This could include investing in research and development, improving charging infrastructure, and providing consumer incentives for EV purchases. By embracing open competition and focusing on these foundational elements, the EU could better position its automotive industry for long-term success in the global EV market while accelerating its transition to sustainable transportation.

References and sources used in the report:

- China’s Electric Vehicle Revolution: Unraveling the Driving Factors, Santosh Charan https://bolt.earth/blog/china-s-electric-vehicle-revolution-unraveling-the-driving-factor

- Commission investigation, EU Commission https://ec.europa.eu/commission/presscorner/detail/en/ip_24_3231

- Why have EV sales dropped in 2024?, Emer Barry, SEAI https://www.seai.ie/blog/ev-sales-drop-2024may21

- Digital economy report 2024, UNCTAD https://unctad.org/publication/digital-economy-report-2024

- Electric vehicle adoption and market trends, International Energy Agency (IEA) https://www.iea.org/reports/global-ev-outlook-2023

- Depth analysis of EV markets and pricing trends https://about.bnef.com/electric-vehicle-outlook

- Trabajo Fin de Grado (TFG), Jianan Zhu, Universidad de Valladolid “Investigaci n del Mercado y Marketing de veh culos de nueva energ a en China” https://uvadoc.uva.es/bitstream/handle/10324/63820/TFG-J-595.pdf?sequence=1