Table of Contents

- Summary

- Background

- Methodology

- Overview of Data Collection

- Survey Design

- Sample Size and Composition

- Data Processing

- Adaptations for 2024 Survey

- Focus Areas of the Survey

- Findings

- Overview of Consumer Saving Behavior

- Impact of Economic Factors

- Demographic Variations

- Payment Methods and Preferences

- Discussion

- Behavioral Economics and Saving Trends

- Impact of Inflation on Saving Motives

- Has the savings paradigm in Europe in flux?

- Cultural Context and Economic Education

- Macroeconomic Implications

- Author’s point of view

- References

Summary

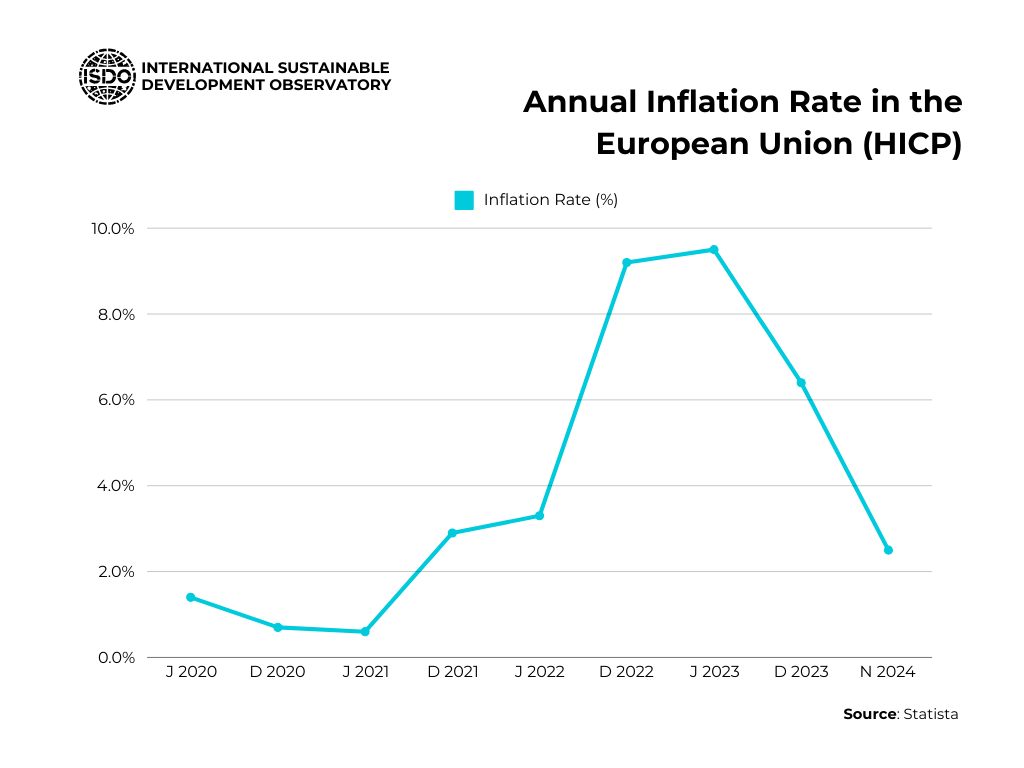

Between 2020 and 2024, European consumer saving behavior underwent significant transformations in response to unprecedented economic challenges, notably high inflation and the ongoing repercussions of the COVID-19 pandemic. Inflation rates surged dramatically, peaking at 10.6% in October 2022, driven largely by rising energy and food prices, coupled with ongoing supply chain disruptions.[1][2] This in- flationary environment prompted households across Europe to adopt more cautious financial strategies, leading to increased saving rates as consumers sought to navi- gate the uncertainties of the economic landscape. The interplay between consumer behavior, inflation, and economic stability has drawn attention from researchers, policymakers, and financial institutions alike, highlighting the notable shifts in financial practices during this tumultuous period.

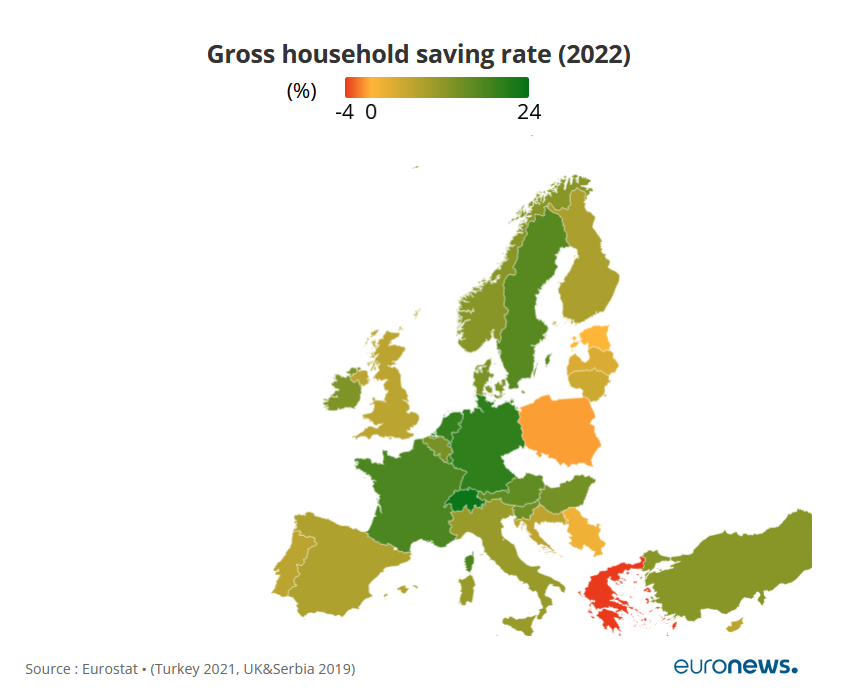

The analysis of saving behaviors during this timeframe reveals substantial de- mographic variations and influences stemming from socioeconomic factors. Younger populations, for example, displayed distinct saving tendencies compared to older age groups, with lower education levels correlating to heightened financial vulnerability.[3] Moreover, regional disparities among European countries such as Poland, Ukraine, and Denmark reflect differences in financial literacy and educational access, shap- ing individuals’ approaches to saving amid economic turbulence.[2] This multifaceted picture underscores the importance of understanding how varying educational and socioeconomic conditions impact consumer saving habits, especially in the context of high inflation.

Notably, the evolution of payment methods and consumer preferences has also been affected by the inflationary period. By 2024, younger consumers increasingly favored digital payment options, while older demographics remained more reliant on cash transactions.[3] The ongoing shift towards digitalization reflects broader trends in consumer finance, as well as the adaptability of households to changing economic conditions. Additionally, the savings behaviors observed during this period have significant macroeconomic implications, particularly as Europe seeks to recover from pandemic-induced economic disruptions and geopolitical tensions, including the conflict in Ukraine and other regional instabilities.[4][5]

This report serves as a comprehensive examination of European consumer saving behavior during the high inflation period, drawing on extensive data from the ECB’s SPACE study, which provides critical insights into payment attitudes and financial decision-making across the euro area. By analyzing these trends, the report aims to inform policymakers and stakeholders about the evolving landscape of consumer finance in Europe, as well as the potential long-term effects on economic stability and growth.[3]

Background

The period between 2020 and 2024 was marked by significant economic turbulence in Europe, primarily driven by the repercussions of the COVID-19 pandemic and the resultant inflationary pressures. Following a notable decline in inflation rates during the late months of 2020, inflation began to rise sharply in early 2021, eventually peaking at 10.6% in October 2022 before declining to 2.9% by December 2023.[1]

This inflationary spike was influenced heavily by increases in energy and food prices, along with various supply chain disruptions, leading to a broader impact on consumer behavior and economic decision-making across Europe.

Geopolitical risks have been identified as key factors contributing to fluctuations in economic stability, particularly in the oil markets, where significant events have historically correlated with spikes in oil prices and economic uncertainty.[6] Events such as terrorist attacks have shown to adversely affect investor and consumer sentiment, leading to decreased economic growth and hampered international trade, which further complicates the financial landscape for individuals and businesses alike.[6]

In this context, the concept of individual economic resourcefulness has gained prominence. Economic knowledge and education have been found to play crucial roles in shaping saving behaviors, particularly among young people entering the labor market.[2] Research suggests that disparities in socioeconomic conditions and levels of financial education among different European countries, such as Poland, Spain, and Denmark, influence saving habits significantly. For instance, while most respondents from these countries expressed a propensity to save, the frequency and nature of their saving behaviors differed markedly, reflecting varied educational, cultural and economic circumstances.[2]

Additionally, the broader economic environment, characterized by increased inflation rates and uncertainty, has led to heightened saving behaviors among consumers as they navigate financial instability.[7] The interconnection between real GDP growth, inflation, and consumer saving patterns underscores the importance of understand- ing these dynamics in the wake of geopolitical and economic challenges that have beset Europe during this period. This analysis aims to provide a comprehensive overview of how these factors have influenced consumer behavior, particularly in terms of saving practices, amid a backdrop of high inflation and economic uncertainty.

Methodology

Overview of Data Collection

The analysis of European consumer saving behavior during the high inflation period between 2020 and 2024 primarily relies on data from the ECB’s SPACE study, which systematically investigates payment attitudes and behaviors across the euro area. This study is conducted every two years, with the latest iteration, SPACE 2024, involving a comprehensive survey across 18 euro area countries, excluding Germany and the Netherlands, where national surveys were also conducted but were harmonized with the ECB’s methodology [3].

Survey Design

The SPACE study employs a combination of quantitative methodologies, utilizing both computer-assisted telephone interviews (CATI) and computer-assisted web interviews (CAWI). In the recent study, approximately 50% of the interviews were conducted via each method. The sample for CATI was drawn using probabilistic methods, while CAWI samples were sourced from non-probabilistic online panels managed by Ipsos, a market research company responsible for data collection. To ensure representativeness, quotas were established for demographic variables such as country, age, gender, and day of the week [3].

Sample Size and Composition

A total of 40,981 respondents participated in SPACE 2024. Specifically, Germany reported 5,698 respondents, with 4,036 contributing to the payment diary, while the Netherlands had 5,150 respondents for the main questionnaire and 3,732 for the payment diary. The survey rounds were strategically distributed across different months of the year to capture seasonal patterns in payment behavior [3][8].

Data Processing

After data collection, rigorous processes were implemented for data cleaning, editing, and imputation. The final sample was weighted to correct for observable biases, facilitating accurate inferences based on demographic characteristics. This step is crucial for understanding trends in consumer saving behaviors, especially in the context of rising inflation, as the analysis examines the implications of payment behaviors and preferences on saving practices [3].

Adaptations for 2024 Survey

Notable changes in the 2024 survey include the introduction of private payments to another person as a distinct category of online payments. The response options for various payment instruments were also updated to reflect the evolving payments landscape, allowing for more effective analysis of contemporary consumer behaviors. However, it is essential to note that the data on person-to-person (P2P) payments is not comparable with previous SPACE iterations due to these updates [3][8].

Focus Areas of the Survey

Respondents provided insights not only into their payment behaviors but also expressed their attitudes towards cash and cashless instruments. Additional queries addressed perceived advantages of various payment methods, behavior surrounding cash withdrawals, access to financial products, and the availability of internet services. This multifaceted approach aims to yield comprehensive insights into the factors influencing saving behaviors during the high inflation period [3].

Findings

Overview of Consumer Saving Behavior

During the high inflation period from 2020 to 2024, significant changes were observed in consumer saving behavior across Europe. The analysis, which primarily focused on households in Germany, France, Italy, Spain, the Netherlands, and Belgium, highlighted a marked increase in the aggregate saving ratio. This increase was driven largely by involuntary savings related to COVID-19 restrictions and the accompanying fear of infection, alongside a notable precautionary motive that had existed prior to the pandemic [9][10].

The behavioural findings are consistent with those established by Amir Shoham and Miki Malul, in 2012 , in ‘The role of cultural attributes in savings rates’, Cross Cultural Management: An International Journal, Vol. 19 Iss: 3 pp. 304 – 314: “Cultural variables, particularly the level of uncertainty avoidance and collectivism, have a significant impact on the level of savings. As the level of uncertainty avoidance increases, the level of national savings increases. In addition, the more collectivist the society, the higher the savings rate.” This is reflected in the different responses to inflation across countries in Europe, with those nations with more collectivist and fearful traditions generally being the ones that save the most in the face of uncertain scenarios. On the other hand, according to the study mentioned above “Understanding that low levels of savings in a nation are mainly a factor of culture means that consumption will remain high even when a country makes significant changes in interest rates or other economic factors.”

“Cultural variables, particularly the level of uncertainty avoidance and collectivism, have a significant impact on the level of savings. As the level of uncertainty avoidance increases, the level of national savings increases. In addition, the more collectivist the society, the higher the savings rate.”

Amir Shoham and Miki Malul, ‘The role of cultural attributes in savings rates’

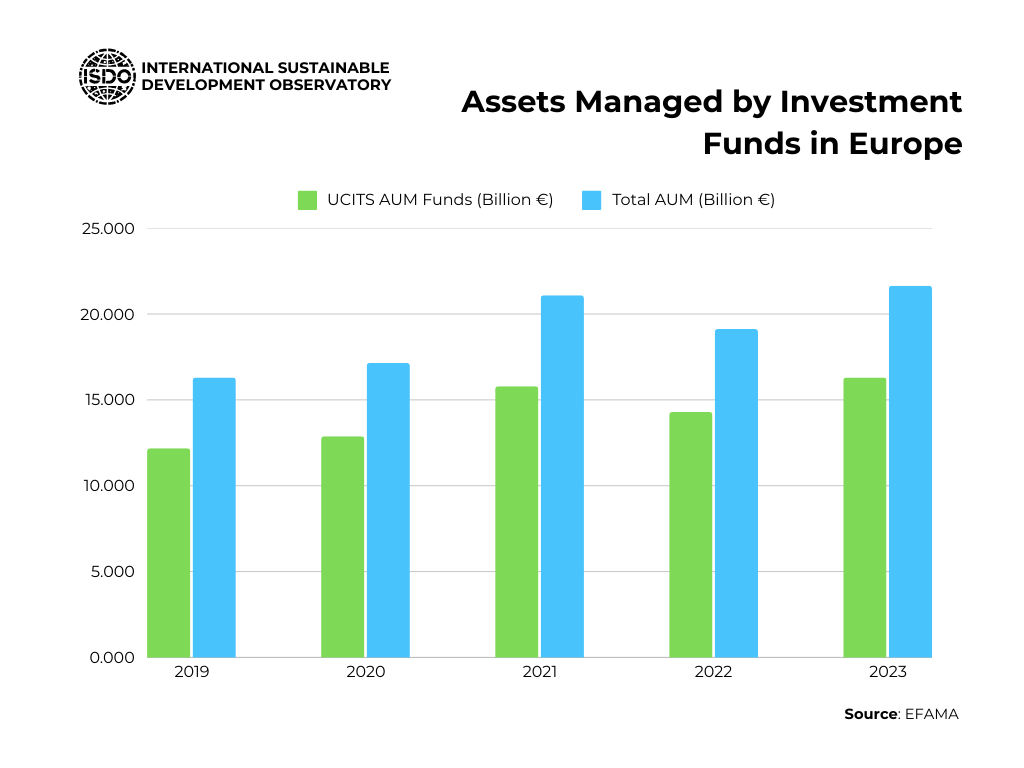

A notable aspect of the reports is the apparent absence of a direct correlation between the increasing level of savings and potential increase of investment in capital goods. This may indicate that those societies that are more fearful see savings as a way of trying to maintain their social situation in the face of money depreciation and uncertain scenarios, not as a mechanism for investment and correction of loss of purchasing power. Curiously, the oposite behavior was observed between territories and population groups characterized by higher purchasing power and educational attainment.

Impact of Economic Factors

The findings indicated that the increase in inflation during the first half of 2021 was a consequence of several factors, including the lifting of deflationary pressures from the pandemic’s acute phase and temporary supply-demand mismatches as economic sectors reopened [1]. Consumer sentiment reflected these changes, with households showing varying consumption patterns when comparing their spending over the past year to pre-pandemic levels. Many reported a decrease in consumption, indicating a shift towards saving amid uncertain economic conditions [10].

Key indicators and growth rates of selected transactions of the euro area:

| 2022 | 2023 | 2024 | ||||||

|---|---|---|---|---|---|---|---|---|

| Q3 | Q4 | Q1 | Q2 | Q3 | Q4 | Q1 | Q2 | |

| Households | ||||||||

| Saving rate, % | 13.3 | 13.4 | 13.8 | 14.0 | 14.0 | 14.5 | 15.2 | 15.7 |

| Investment rate, % | 10.1 | 10.0 | 10.0 | 9.8 | 9.7 | 9.5 | 9.3 | 9.2 |

| Gross disposable income, quarter-over-quarter change (%) | 3.1 | 1.7 | 2.2 | 1.3 | 1.1 | 1.2 | 2.0 | 0.8 |

| Individual consumption expenditure, quarter-over-quarter change (%) | 2.9 | 1.6 | 1.6 | 1.2 | 1.0 | 0.6 | 1.2 | 0.2 |

| Gross fixed capital formation, quarter-over- quarter change (%) | 1.4 | 0.9 | 2.2 | -1.3 | 0.7 | -1.0 | 0.1 | -0.6 |

| Non-financial corporations | ||||||||

| Profit share, % | 41.3 | 41.3 | 41.6 | 40.9 | 40.4 | 39.9 | 39.1 | 38.8 |

| Investment rate, % | 22.9 | 22.1 | 22.5 | 22.6 | 22.3 | 22.0 | 22.3 | 21.3 |

| Gross value added, quarter-over-quarter change (%) | 2.1 | 2.1 | 2.5 | 0.5 | 0.6 | 0.6 | 0.1 | 0.7 |

| Compensation of employees and other taxes less subsidies on production, quarter-over-quarter change (%) | 1.5 | 2.2 | 2.0 | 1.7 | 1.5 | 1.4 | 1.5 | 1.2 |

| Gross fixed capital formation, quarter-over-quarter change (%) | 2.9 | -1.5 | 4.6 | 0.8 | -0.8 | -0.5 | 1.2 | -3.7 |

Source: Eurostat

Key Indicators of ECB Monetary Policy (2020-2024)

| Year | Eurosystem Balance Sheet (€ Billions) | Net APP Purchases (€ Billions) | Main Refinancing Operations (MRO) Interest Rate (%) (Year-end) | Notes |

|---|---|---|---|---|

| 2020 | 6,983 (Dec) | 977 (Annual net) | 0.00 | Massive expansion due to the pandemic. Beginning of the PEPP. |

| 2021 | 8,564 (Dec) | 993 (Annual net) | 0.00 | Continued expansion. |

| 2022 | 8,435 (Dec) | 338 (Annual net until November, then reinvestments) | 2.50 | Start of the transition towards a more restrictive policy. End of PEPP in March. |

| 2023 | 7,956 (Dec) | Net reduction of the balance sheet due to TLTROs and non-reinvestment of the APP | 4.50 | Tightening of monetary policy. Rate hikes and balance sheet reduction. |

| 2024 | Data not available fully consolidated | Net reduction of the balance sheet due to non-reinvestment of the APP | 4.50 | Continued tightening. |

Sources:

- Eurosystem Balance Sheet: ECB. Eurosystem statistics.

- Net APP Purchases: ECB. Monetary policy press releases.

- MRO Interest Rate: ECB. Key ECB interest rates.

Demographic Variations

The survey results demonstrated notable demographic variations in saving behavior. The younger segments of the population (aged 18-24) displayed a reluctance to hold payment accounts compared to older age groups, though this gap diminished by 2024 [3]. Additionally, individuals with lower education levels and incomes below €1,000 reported a greater need for financial assistance, highlighting the disparate impact of the economic landscape on different demographic groups [3].

Payment Methods and Preferences

In terms of payment preferences, cash usage among consumers under 40 fell below 50% of point-of-sale transactions by 2024, whereas older consumers aged 65 and above continued to rely more heavily on cash, with a share of 57% [3]. Furthermore, the analysis revealed that higher education and income levels were associated with a greater inclination towards digital payment methods for higher-value transactions, reflecting a broader trend towards digitalization in consumer finance [3][1].

Discussion

A critical aspect of discussion revolves around the increase in household savings, which has been characterized by both precautionary motives and forced savings due to restricted consumption opportunities during lockdowns and the growing fear of the volatility of certain securities and their resilience in the face of conflcitve geopolitical scenarios [11]. This phenomenon has prompted researchers and policymakers to explore the implications of these savings on future consumption recovery and overall economic stability.

The prevailing paradigm regarding savers as rational agents who seek to optimize their investments and minimize risks has been subject to scrutiny. An increasing number of factors are exerting influence on the behavior of savers and investors, thereby altering their decision-making processes and even leading to the discontinuation of certain historical behaviors. This unpredictable behavior can be attributed to the advent of the information age, during which investors are more over-informed than ever before and take actions driven by information that is capable of reversing established paradigms.

Behavioral Economics and Saving Trends

Recent studies indicate that consumer behavior in the banking sector does not always align with traditional neoclassical economic models, which assume rational decision-making. Instead, behavioral economics provides a more nuanced understanding of saving behaviors, highlighting factors such as loss aversion and socio-demographic influences. For example, individuals tend to save differently based on their income levels and cultural attributes, leading to variations in saving rates across different European countries [7][2]. This complexity necessitates a multi-faceted approach to analyzing consumer behavior, especially in the context of high inflation, where economic knowledge and cultural factors play significant roles in shaping individual saving decisions.

Impact of Inflation on Saving Motives

Inflation has further complicated the savings landscape, with poorer households facing higher expenditures relative to their income, particularly on essentials like energy [12]. This has led to a duality in saving motives; while some households prioritize saving for immediate needs, others may save for future investments or retirement. In wealthier households, the focus tends to be more on savings for old age and wealth accumulation, contrasting with the motivations observed in less affluent households [2]. This divergence underscores the importance of socioeconomic status in determining saving behavior during inflationary periods.

Has the savings paradigm in Europe in flux?

The question of whether there is data justifying a paradigm shift in how European savers react to inflation is complex and doesn’t have a simple “yes” or “no” answer. Rather, what we observe is an evolution in saving strategies, influenced by various factors, where some behaviors intensify and others emerge.

Arguments in favor of a paradigm shift (or at least a significant evolution):

- Prolonged period of low interest rates: For over a decade, interest rates in Europe remained at historically low levels, even negative in some cases. This disincentivized traditional saving in bank deposits, as returns were practically zero. This context forced savers to seek more profitable investment alternatives, often assuming greater risk.

- Increased access to information and financial products: Digitalization and the development of financial technology (fintech) have democratized access to information and a wide range of investment products. Savers now have more tools to compare, diversify, and manage their investments, allowing them to react more actively to inflation.

- Increased awareness of inflation: The recent inflationary surge has generated greater public awareness of the effects of inflation on purchasing power. Savers are more aware of the need to protect their savings from inflationary erosion.

- Search for safe-haven assets: In a context of high inflation and economic uncertainty, there is increased demand for safe-haven assets, such as gold, real estate, or inflation-indexed assets. This behavior reflects a greater concern for preserving capital value.

- Greater portfolio diversification: Savers, especially those with greater wealth, tend to diversify their investment portfolios more, including assets from different classes and geographies, as a strategy to mitigate risk and seek returns in an inflationary environment.

Data supporting these arguments:

- Increased investment in investment funds and other investment products: Data from investment fund associations and financial institutions show an increase in investment in products other than traditional deposits, such as investment funds, pension plans, and other long-term savings products.

- Growth of the digital asset market: Although with high volatility, the cryptocurrency and other digital asset market has attracted a growing number of investors, some of whom seek to hedge against inflation.

- Data on home purchases: In some markets, an increase in demand for housing as a safe-haven investment against inflation is observed.

- Surveys on saver behavior: Various surveys conducted by consumer organizations, financial institutions, and research centers show greater concern about inflation and a greater willingness to take risks to obtain returns.

However, there are also factors that limit a complete paradigm shift:

- Risk aversion: Many savers, especially those with less wealth or greater risk aversion, still prefer traditional low-risk savings products, even if returns are low.

- Limited financial literacy: Lack of financial education can hinder understanding of more complex investment products and limit savers’ ability to make informed decisions.

- Unequal access to financial products: Not all savers have the same access to a wide range of financial products, which limits their investment options.

Note: It is imperative to persist in the observation of the evolution of saver behavior in response to inflation and other economic factors to achieve a more profound comprehension of long-term trends.

Cultural Context and Economic Education

Cultural attributes have also been shown to influence saving behavior significantly. Higher levels of long-term orientation within a society are associated with increased saving rates, suggesting that cultural perceptions of time and economic stability can shape individual financial behaviors [2]. Moreover, educational factors play a critical role in equipping individuals with the knowledge necessary to navigate economic uncertainties. Variations in financial literacy among young people in different countries reflect the broader socioeconomic contexts, impacting their saving habits and future financial decisions [3].

Macroeconomic Implications

The macroeconomic implications of altered saving behaviors are profound, particularly as Europe navigates recovery from the pandemic and ongoing geopolitical tensions, such as the conflict between Russia and Ukraine and the Israel-Hamas conflict [4]. Understanding the direct and indirect effects of these shocks on consumer confidence and spending is essential for crafting effective monetary and fiscal policies. Evidence from recent evaluations indicates that households’ financial expectations are closely linked to consumption growth, emphasizing the need for targeted interventions to bolster consumer confidence during periods of uncertainty [5].

Author’s point of view:

As an adherent of the Austrian School of Economics, I find the analysis particularly intriguing. The document presents a comprehensive overview of the trends; however, it is crucial to interpret these findings.

From my perspective, the observed fluctuations in saving rates are a direct consequence of the distortionary effects of inflation on economic calculation. The initial surge in savings, followed by a subsequent decline, demonstrates how monetary expansion disrupts the natural rhythm of time preference and capital accumulation.I posit that the expansionary policies implemented by central banks, intended to stimulate economic activity, have inadvertently fostered misinvestment. The artificial lowering of interest rates has likely led to a misallocation of resources, resulting in an unsustainable boom that will inevitably give way to a bust.

The regional disparities in saving patterns that are highlighted in the study underscore a fundamental tenet of Austrian thought: the significance of decentralized knowledge and the heterogeneity of economic actors.These variations serve to demonstrate the inherent flaws of centralized economic planning and the reliance on the spontaneous order of the market.

Furthermore, it is contended that government interventions, such as fiscal stimuli and regulatory measures, have served to exacerbate market distortions. While well-intentioned, these policies impede the price mechanism’s capacity to convey precise information regarding scarcity and consumer preferences.

The study’s findings appear to align with the Austrian perspective that stable monetary policy and minimal government intervention are indispensable for sustainable economic growth. In essence, it all fits the hypothesis that pandemic credit expansion was the main trigger for the subsequent inflation. The observed saving behaviors are indicative of underlying structural deficiencies within our monetary system, and addressing these fundamental causes is imperative for cultivating that generates non-inflationary environments with authentic economic prosperity.

References

[1]: The 2021-2022 inflation surges and monetary policy in the euro area

[2]: Turbulent times: geopolitical risk and its impact on euro area …

[3]: The role of cultural attributes in savings rates – Academia.edu

[4]: A Behavioral Perspective on Saving Decisions. Empirical Evidence for …

[5]: Study on the payment attitudes of consumers in the euro area 2024

[6]: The euro area inflation outlook: – European Central Bank

[7]: ECB Consumer Expectations Survey results – July 2024

[8]: Household saving during the COVID-19 pandemic … – European Central Bank

[9]: The consumption impulse from pandemic savings – European Central Bank

[10]: The recent drivers of household savings across … – European Central Bank

[11]: Impact of geopolitical surprises on euro area inflation varies case by …

[12]: Why are euro area households still gloomy and … – European Central Bank

doi:10.7910/DVN/P46EHH