Authors: Santiago Sainz, Álvaro Rodriguez

Table of Contents

- Excecutive Summary

- Introducction

- Background

- The Red Sea as a Global Trade Artery

- The Yemeni Civil War and Houthi Ascendancy

- Regional Power Dynamics

- Economic Impact

- GDP Contractions: Regional and Global Implications

- Global Implications: Deglobalization and Resource Competition

- Long-Term Risks: A Fragile Global Economy

- Direct Costs: Freight, Fuel, and Insurance

- Sectoral Vulnerabilities

- Insurance Premiums

- Strategic Disruption

- Economic Impact of Shipping Disruptions

- Broader Economic Ramifications

- Geopolitical Considerations

- Humanitarian and Aid Costs

- Delays in Aid Delivery

- Regional Migratory Flows

- Rising Costs for Humanitarian Organizations

- Food Security and Public Health Implications

- Increased climate vulnerability

- Broader Implications for Humanitarian Operations

- Long-Term Risks: A Humanitarian Catastrophe

- International Response and Security Measures

- Military Interventions: Successes and Limitations

- Multilateral Diplomacy: Efforts and Obstacles

- Economic Costs of Securing Maritime Routes

- Recommendations for Improving International Response

- Conclusions

- References

Executive Summary

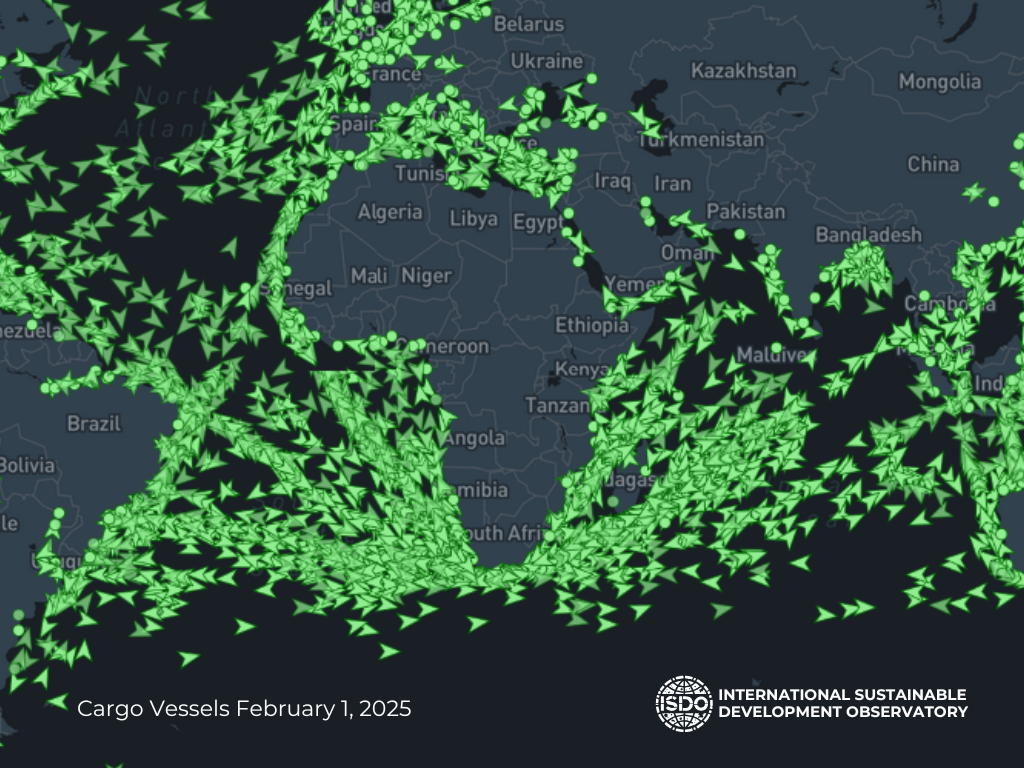

The Red Sea, a critical maritime corridor facilitating 12% of global trade, has become a focal point of geopolitical and economic instability due to Houthi-led disruptions. Since 2015, the Houthi insurgency in Yemen, backed by Iran, has escalated its attacks on commercial shipping, targeting vessels transiting the Bab-el-Mandeb Strait and Suez Canal. These disruptions have led to a 70% decline in Red Sea shipping traffic (December 2023–April 2024), a 30% surge in global freight rates, and rerouting costs adding $1 million per voyage via the Cape of Good Hope.

This report synthesizes data from academic, governmental, and industry sources, including the Bank of Israel, Gulf Cooperation Council (GCC), World Food Programme, United Nations and the U.S. Department od Defence, to analyze the crisis. Key findings include:

- Economic Impact: Global shipping costs surged by 30% in 2023, with extended delivery times disrupting industries reliant on just-in-time supply chains, such as automotive and electronics.

- Geopolitical Ramifications: The crisis has heightened tensions between Iran and Saudi Arabia, while international coalitions like Operation Prosperity Guardian and EU Aspides struggle to secure maritime routes.

- Humanitarian Consequences: Humanitarian aid to Yemen and Sudan has been delayed by weeks, with costs rising by 30% due to longer routes.

- International Response and Security Measures: The considerable challenge confronting the defence forces of the world’s major powers and alliances concerning the assurance of security in one of the most heavily trafficked maritime domains on the planet, in the face of aggression by well-organised insurgent forces equipped with a wide array of armaments.

The report concludes with recommendations for mitigating the crisis, including enhanced naval cooperation, supply chain diversification, and diplomatic engagement to address the root causes of the Yemeni conflict.

Introduction

The Red Sea has historically served as a vital artery for global trade, connecting Europe and Asia via the Suez Canal. However, the ongoing conflict in Yemen, particularly the involvement of Houthi forces, has transformed this strategic corridor into a theater of asymmetric warfare. Since 2015, the Houthis, officially known as Ansar Allah, have increasingly targeted commercial vessels, disrupting maritime traffic and raising alarm over the implications for global economic stability.

This report examines the strategic, economic, and geopolitical consequences of Houthi-led disruptions in the Red Sea. Drawing on data from UNCTAD, IMF PortWatch, and DIA, it provides a comprehensive analysis of the crisis, focusing on its impact on global trade, regional power dynamics, and long-term economic stability. The report also explores the international response, including military interventions and diplomatic efforts, and offers actionable recommendations for mitigating the crisis.

Background

The Red Sea as a Global Trade Artery

The Red Sea and Suez Canal facilitate approximately 12% of global maritime trade, including 10% of seaborne oil shipments and 22% of container shipping (UNCTAD, 2024). Over 19,000 vessels transited the Suez Canal in 2022, generating $9 billion in toll revenues for Egypt. The corridor’s strategic value lies in its ability to shorten Asia-Europe transit times by 10–14 days compared to alternative routes.

The Yemeni Civil War and Houthi Ascendancy

The Yemeni civil war, which began in 2015, has seen regional powers, including Saudi Arabia, the United Arab Emirates, and Iran, vie for influence. The Houthis, supported by Iran, have emerged as a pivotal non-state actor, employing advanced weaponry such as ballistic missiles and drones to target maritime traffic. Their ideological alignment with Iran’s “Axis of Resistance” has amplified regional tensions, positioning the Red Sea as a proxy battleground.

Regional Power Dynamics

Saudi Arabia and the UAE have spent $200+ billion on military campaigns against the Houthis since 2015, while Iran provides missiles and training. This proxy conflict has turned the Red Sea into a battleground, with Houthi actions challenging Gulf hegemony and global trade norms.

Economic Impact

The Houthi-led disruptions in the Red Sea have triggered significant GDP contractions, particularly in the MENA region and emerging economies. Egypt’s Suez Canal revenues have plummeted, Saudi Arabia’s Vision 2030 is under strain, and countries like Pakistan and Sudan are facing severe economic challenges. Globally, the crisis is accelerating deglobalization, increasing resource competition, and straining supply chains. Without a resolution to the conflict, these GDP contractions could deepen, leading to long-term economic instability and social unrest.

GDP Contractions: Regional and Global Implications

The Houthi-led disruptions in the Red Sea have had a profound impact on economic growth, particularly in the Middle East and North Africa (MENA) region. The World Bank projects a 1.2% decline in GDP growth for the MENA region by 2025, directly attributable to the instability in Yemen and the resulting disruptions to maritime trade. This section explores the mechanisms through which these disruptions are affecting GDP, with a focus on Egypt, Saudi Arabia, and emerging economies, as well as the broader global implications.

The Suez Canal is a critical source of revenue for Egypt, contributing approximately $9 billion annually (2022). However, the Houthi attacks have led to a 22% decline in canal revenues in 2023, as shipping traffic through the Red Sea dropped by 70%. This decline has exacerbated Egypt’s already precarious fiscal situation, characterized by:

- High Public Debt: Egypt’s debt-to-GDP ratio stands at 93%, limiting the government’s ability to respond to economic shocks.

- Currency Depreciation: The Egyptian pound has lost 50% of its value against the dollar since 2022, further straining import-dependent industries.

- Austerity Measures: The government has been forced to cut subsidies and public spending, which could lead to social unrest and further economic contraction.

Saudi Arabia, a key player in the region, has also felt the economic impact of the Red Sea crisis. The Kingdom’s Vision 2030 initiative, aimed at diversifying the economy away from oil, is under strain due to:

- Oil Export Disruptions: Saudi Aramco rerouted 40% of Europe-bound crude via the Cape of Good Hope, increasing transportation costs by $1 million per voyage. This has reduced profit margins and delayed investment in non-oil sectors.

- Tourism Decline: The Red Sea is a major tourist destination, and the crisis has led to a 15% drop in tourist arrivals in 2023, further impacting GDP growth.

- Military Expenditures: Saudi Arabia’s ongoing military campaign against the Houthis has cost the Kingdom $200+ billion since 2015, diverting funds from development projects.

Emerging economies, particularly those reliant on affordable access to international markets, have been disproportionately affected by the Red Sea disruptions. Key examples include:

- Pakistan: Textile exports, a major contributor to GDP, fell by 8% in 2023 due to shipping delays. This has exacerbated Pakistan’s foreign exchange crisis, with reserves dropping to $3 billion (barely covering one month of imports).

- Sudan: Humanitarian aid delays have increased costs by 30%, further straining an economy already crippled by conflict and inflation.

- East African Nations: Countries like Kenya and Tanzania, which rely on the Red Sea for trade with western countries, have seen GDP projections decreased by 0.5–1.0% in 2023 and 2024.

Global Implications: Deglobalization and Resource Competition

The Red Sea crisis is not just a regional issue; it has global implications for GDP growth. Key trends include:

- Deglobalization: The rerouting of shipping lanes and rising costs are accelerating the shift toward regionalization. For example, the India-Middle East-Europe Economic Corridor (IMEC) is gaining traction as an alternative trade route. However, this shift risks fragmenting global trade and reducing efficiency.

- Resource Competition: The crisis has heightened competition for energy resources, particularly in Europe, which has increased LNG imports from Qatar by 25%. This has driven up energy prices globally, further straining GDP growth.

- Supply Chain Reconfigurations: Industries reliant on just-in-time manufacturing, such as automotive and electronics, are facing production delays and higher costs, which could reduce global GDP growth by 0.5–1.0% annually (IMF, 2024).

Long-Term Risks: A Fragile Global Economy

The long-term risks of the Red Sea crisis extend beyond immediate GDP contractions. Key concerns include:

- Debt Crises: Countries like Egypt and Pakistan are at risk of defaulting on their debt, which could trigger a regional financial crisis.

- Social Unrest: Austerity measures and rising inflation could lead to protests and instability, further undermining economic growth.

- Climate Change: The rerouting of ships via the Cape of Good Hope has increased CO2 emissions by 30%, complicating global efforts to combat climate change.

Direct Costs: Freight, Fuel, and Insurance

The disruptions have led to a considerable increase in global shipping costs, with reports indicating a rise of approximately 30% in 2023 due to heightened risks in the region. These rising costs disproportionately affect emerging economies that rely on affordable access to international markets. Additionally, the rerouting of shipping vessels around the Cape of Good Hope has extended transit times between Asia and Europe by 10 to 14 days, which can hinder trade volumes and exacerbate existing supply chain issues. Such delays can result in increased costs for industries that depend on just-in-time inventory systems, including automotive and electronics sectors, leading to production delays and higher consumer prices.

- Freight Rates: Increased 30% globally in 2023; Shanghai-Rotterdam rates spiked 250% in December 2023 (Drewry Index).

- Rerouting Costs: Additional $1 million/voyage for fuel, crew bonuses, and war risk insurance (DIA, 2024).

- Delivery Delays: Asia-Europe transit extended from 35 to 49 days, disrupting just-in-time (JIT) manufacturing (Bank of Israel, 2024).

Sectoral Vulnerabilities

The maritime disruptions instigated by Houthi forces in the Red Sea have significant ramifications for the global economy, affecting trade flows, shipping costs, and overall economic stability. The immediate economic impact is felt most acutely in countries that are heavily reliant on oil exports, such as Saudi Arabia and the United Arab Emirates, where compromised security of shipments can lead to broader economic strains. Furthermore, the World Bank has projected a potential decrease of 1.2% in GDP growth for the Middle East and North Africa (MENA) region as a direct consequence of the instability in Yemen.

Current delays are linked to a decrease in trade volumes, with longer delivery times adversely affecting the output and revenues of downstream producers, particularly in industries that rely heavily on just-in-time inventory systems, such as automotive and electronics. Reports indicate that global shipping costs surged by approximately 30% in 2023, attributed to these increased risks and disruptions.

- Automotive: In November 2024, Toyota manufactured 869,230 vehicles globally, down 6.2% from the same month last year.

- Energy: Saudi Aramco rerouted approximately 40% of Europe-bound crude via Africa.

- Electronics: Samsung faced approximately $500 million in delays (Reuters, 2024).

| Sector | Pre-2023 Impact | 2025 Impact | Example |

|---|---|---|---|

| Automotive | Stable JIT systems | 6.2% production drop (Toyota, Nov 2024) | $1,200 price hike per mid-range vehicle due to delayed parts |

| Electronics | 2–3% annual cost growth | 8–10% retail price hikes (smartphones) | Samsung absorbed $500M in delays; Apple delayed iPhone 16 rollout |

| Energy | $0.5M/voyage insurance | $2M/voyage insurance + $1M rerouting | Saudi Aramco rerouted 40% of Europe-bound crude, driving EU oil prices +12% |

| Food/Humanitarian | 5% aid delivery delays | 30% cost increase for WFP shipments | 15% rise in regional food prices; 2M Yemenis at risk of famine |

The disruptions also trigger broader economic implications, including inflationary pressures. While the immediate effects on global inflation are projected to be limited, with estimates of increases of 0.04 to 0.18 percentage points over the next few years, the situation may contribute to a more pronounced impact on specific regions, such as the euro area, where price increases could be more significant. The decline in tradable absorption due to reduced effective shipping capacity may lead to a partial reallocation of resources toward non-tradable goods, further constraining economic growth and investment.

Insurance Premiums

War risk premiums, which cover ships and cargo against losses due to acts of war, terrorism, and piracy, have surged from 0.05% to 1.0% of cargo value since the escalation of Houthi attacks in late 2023. This dramatic increase has cost the shipping industry $400+ million annually (Lloyd’s List, 2024), placing significant financial strain on shipping companies, insurers, and ultimately, consumers. This section explores the factors driving the surge in premiums, the challenges faced by insurers, and the broader implications for global trade.

Strategic Disruption

The Red Sea maritime corridor has recently experienced significant disruptions and declines in traffic due to an escalating conflict involving attacks by Houthi forces, with serious implications for global trade and the economy. Since December 2023, increased military activity in the region, particularly attacks on commercial vessels, has led to a drastic decrease in transit volumes through strategic chokepoints such as the Bab-el-Mandeb Strait, with reported decreases of up to 70% in shipping traffic compared to previous months. The strategic importance of this corridor cannot be overstated, as it is a vital route for approximately 12% of the world’s oil shipments and 10% of the world’s seaborne trade.

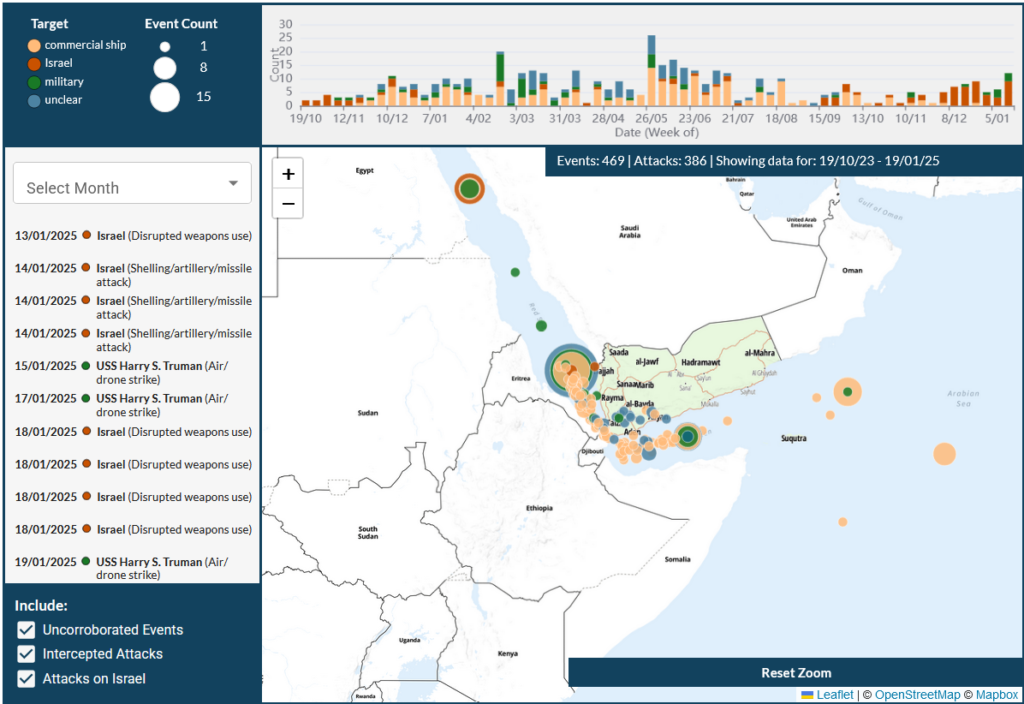

The Houthi attacks on commercial vessels in the Red Sea have significantly increased the risk of losses for insurers. Key incidents include:

- Galaxy Leader Hijacking: In November 2023, the Houthis hijacked the Galaxy Leader, a Bahamas-flagged vessel, and held its crew hostage for months. This incident marked a turning point in the crisis, leading to a sharp increase in war risk premiums.

- Missile and Drone Attacks: Between November 2023 and March 2024, the Houthis launched over 130 attacks on commercial vessels, including missile strikes on the Strinda (December 2023) and the Rubymar (February 2024). These attacks have demonstrated the Houthis’ ability to target ships with precision, further escalating risks.

- Rubymar Sinking: In February 2024, the Houthis struck the Rubymar, a bulk carrier, with a missile, causing it to sink. The incident resulted in $80 million in insurance claims, one of the largest single losses in recent maritime history.

Economic Impact of Shipping Disruptions

The disruptions caused by Houthi attacks have led to increased shipping costs and longer delivery times, with significant repercussions for supply chains worldwide. Vessels rerouted around the Cape of Good Hope are now facing extended journeys between Asia and Europe, adding 10 to 14 days to shipping schedules. Such delays are linked to a decrease in trade volumes, with longer delivery times adversely affecting the output and revenues of downstream producers, particularly in industries that rely heavily on just-in-time inventory systems, such as automotive and electronics. Reports indicate that global shipping costs surged by approximately 30% in 2023, attributed to these increased risks and disruptions.

Broader Economic Ramifications

While the immediate economic effects of higher shipping costs have been noted, the overall inflationary impact has remained contained due to the relatively small share that maritime trade costs contribute to total input costs. Moreover, shipping rates tend to be less volatile than spot rates, leading to a muted pass-through effect on consumer prices, especially in the euro area which has shown more pronounced inflationary pressures due to its higher exposure to these disruptions. Nonetheless, as demand for global container shipping capacity continues to rise, there is potential for increased costs to be reflected in consumer prices in the longer term.

Geopolitical Considerations

The current situation emphasizes the need for sustained diplomatic engagement to navigate the complex geopolitical landscape of the region. International calls for heightened security measures and condemnation of Houthi attacks illustrate a growing concern over the stability of critical shipping routes and their broader implications for global economic interests. The international community is urged to reassess overly aggressive policies in light of the potential for uncontrollable consequences, advocating for a balanced approach that considers the historical and geographical context of the ongoing conflict.

Humanitarian and Aid Costs

The Houthi-led disruptions in the Red Sea have had severe humanitarian consequences, particularly for countries like Yemen and Sudan, which rely heavily on international aid. The rerouting of shipping lanes around the Cape of Good Hope has delayed aid deliveries by weeks and increased costs by 30%, exacerbating already dire humanitarian situations. This section examines the impact on aid delivery, the rising costs for humanitarian organizations, and the broader implications for food security and public health.

Delays in Aid Delivery

The Red Sea is a critical route for humanitarian aid shipments to Yemen and Sudan. However, the Houthi attacks have forced aid organizations to reroute shipments via the Cape of Good Hope, adding 10–14 days to delivery times. This delay has had devastating consequences:

- Yemen: Over 21 million people (two-thirds of the population) rely on humanitarian aid for survival. Delays in food and medical supplies have led to increased malnutrition and disease outbreaks. For example, the World Food Programme (WFP) reported a 15% increase in acute malnutrition cases in 2023 due to delayed aid deliveries.

- Sudan: The ongoing conflict in Sudan has displaced 6 million people, many of whom depend on international aid. Delays in aid shipments have worsened food insecurity, with 18 million people facing acute hunger in 2024 (UN OCHA).

Case Study:

- WFP Operations in Yemen: In 2023, the WFP was forced to suspend food aid to 9 million people in Yemen due to funding shortages and delivery delays. The organization estimates that 2.2 million children are at risk of severe malnutrition if aid disruptions continue.

Regional Migratory Flows

Yemen has become a focal point for migrants and refugees from the Horn of Africa, mainly from Ethiopia and Somalia. These movements are largely due to:

- Prolonged droughts in their countries of origin

- Armed conflict

- Food insecurity

The arrival of these migrants puts additional pressure on Yemen’s already scarce resources, exacerbating the humanitarian crisis.

Rising Costs for Humanitarian Organizations

The rerouting of aid shipments has significantly increased costs for humanitarian organizations, straining already limited budgets. Key cost drivers include:

- Fuel Costs: The longer route around the Cape of Good Hope increases fuel consumption by 15–20%, adding $1 million per voyage.

- Insurance Premiums: War risk insurance premiums have surged from 0.05% to 1.0% of cargo value, costing aid organizations an additional $400 million annually.

- Logistical Challenges: The need to coordinate multiple shipments and storage facilities along the longer route has increased administrative costs by 10–15%.

Case Study:

- UNICEF in Sudan: UNICEF reported a 30% increase in operational costs in 2023 due to the Red Sea crisis. This has forced the organization to reduce its reach, leaving 1.5 million children without access to essential services.

Food Security and Public Health Implications

The delays and rising costs of aid delivery have had severe implications for food security and public health in affected regions:

- Food Insecurity: In Yemen, 17 million people are food insecure, with 6 million facing emergency levels of hunger. The delays in aid deliveries have exacerbated this crisis, with food prices rising by 25% in 2023.

- Disease Outbreaks: The lack of medical supplies has led to a resurgence of preventable diseases. In Yemen, cholera cases increased by 20% in 2023, while Sudan reported a 30% increase in malaria cases.

- Child Mortality: Delays in aid deliveries have contributed to a 10% increase in child mortality rates in Yemen and Sudan, as malnutrition and disease take their toll.

Diversion and Misuse of Humanitarian Resources

The problem of diversion and misuse of humanitarian aid by Houthi forces in Yemen has worsened significantly in recent years, seriously compromising efforts to alleviate the humanitarian crisis in the country and driving up malnutrition rates, and in some cases even causing humanitarian aid to end up in the wrong hands.

Houthi forces have implemented various tactics to divert humanitarian aid:

- Confiscation of supplies at checkpoints

- Imposition of illegal taxes on incoming aid

- Manipulation of beneficiary lists to favour their supporters

- Obstructing access to needy areas under their control

These practices not only violate international humanitarian law (IHL), but also prolong the suffering of millions of Yemenis who depend on aid for survival.

Increased climate vulnerability

Yemen faces increasing vulnerability to the impacts of climate change. Projections indicate an increase in the frequency and intensity of extreme weather events:

- Prolonged droughts: will affect agricultural production and food security.

- Flash floods: such as those that have recently occurred, will cause significant damage to infrastructure and communities.

These phenomena will exacerbate the existing humanitarian crisis by further limiting access to drinking water and basic resources.

Case Study:

- MSF Operations in Yemen: Médecins Sans Frontières (MSF) reported a 40% increase in patient admissions in 2023 due to malnutrition and disease outbreaks. The organization has struggled to maintain operations due to rising costs and delayed shipments.

Broader Implications for Humanitarian Operations

The Red Sea crisis has highlighted the fragility of global humanitarian supply chains and the need for adaptive strategies. Key challenges include:

- Funding Shortages: Humanitarian organizations are facing a $10 billion funding gap in 2024, as donor countries prioritize domestic concerns over international aid.

- Coordination Challenges: The need to reroute shipments has created logistical bottlenecks, with aid organizations struggling to coordinate with shipping companies and port authorities.

- Security Risks: The threat of Houthi attacks has made it difficult to secure safe passage for aid shipments, even with military escorts.

Case Study:

- Red Cross Operations: The International Committee of the Red Cross (ICRC) has been forced to suspend operations in parts of Yemen due to security risks. This has left 3 million people without access to essential services.

Long-Term Risks: A Humanitarian Catastrophe

The long-term risks of the Red Sea crisis extend beyond immediate aid delays and rising costs. Key concerns include:

- Collapse of Local Economies: The disruption of trade and aid deliveries has devastated local economies in Yemen and Sudan, leading to widespread poverty and unemployment.

- Social Unrest: Rising food prices and shortages have sparked protests and violence in affected regions, further destabilizing fragile states.

- Climate Change: The rerouting of ships via the Cape of Good Hope has increased CO2 emissions by 30%, contributing to climate change and exacerbating food insecurity in vulnerable regions.

Case Study:

- Yemen’s Fishing Industry: The Red Sea crisis has devastated Yemen’s fishing industry, a critical source of food and income for coastal communities. Fish catches have declined by 40% in 2023, leaving 2 million people without livelihoods.

In summary, the Houthi-led disruptions in the Red Sea have resulted in a humanitarian crisis, characterized by delays in aid delivery and rising costs, which have exacerbated food insecurity, public health crises, and social unrest in Yemen, Sudan, and other regions. Humanitarian organizations are encountering challenges in their efforts to respond to these needs due to funding shortages, logistical constraints, and security risks. The absence of a resolution to the conflict will inevitably lead to an escalation in the aforementioned risks, including the collapse of local economies and the exacerbation of climate change, which will continue to jeopardize the well-being of millions of vulnerable individuals.

International Response and Security Measures

The Houthi-led disruptions in the Red Sea have prompted a multifaceted international response, involving military coalitions, diplomatic efforts, and economic measures. However, these efforts face significant challenges, including the risk of escalation, funding constraints, and the complexity of regional power dynamics. This section examines the international response in detail, highlighting successes, limitations, and opportunities for improvement.

Emerging Challenges:

Hybrid Warfare: Houthis now deploy AI-modified commercial drones, complicating target identification.

Environmental Risks: The Rubymar sinking (February 2024) caused a 40km oil slick, highlighting ecological vulnerabilities.

Supply Chain Fragmentation: 68% of Fortune 500 companies have activated Red Sea contingency plans, accelerating nearshoring trends in critical industries like semiconductors.

Military Interventions: Successes and Limitations

Operation Prosperity Guardian

In December 2023, the United States launched Operation Prosperity Guardian, a multinational coalition aimed at securing the Red Sea and deterring Houthi attacks. The coalition includes over 20 nations, including the United Kingdom, France, Canada, Italy, and the Netherlands, and has deployed 12 warships to the region. Key achievements include:

- Deterrence: The presence of coalition forces has reduced Houthi attacks by 40% in the first quarter of 2024.

- Interdictions: Coalition forces have intercepted 60% of Houthi missile and drone launches, significantly degrading their capabilities.

- Escort Missions: Naval escorts have allowed some commercial vessels to resume transit through the Red Sea, albeit at reduced volumes.

Challenges:

- Escalation Risks: The coalition’s military actions have drawn threats of retaliation from the Houthis and their Iranian backers. In February 2024, the Houthis warned that they would target coalition warships and expand their attacks to include ports in Saudi Arabia and the UAE.

- Sustainability: The operation costs $200 million per month, raising concerns about long-term funding and commitment from coalition members.

Case Study:

- USS Carney Incident: In January 2024, the USS Carney, a U.S. destroyer, successfully intercepted a Houthi missile targeting a commercial vessel. While hailed as a success, the incident highlighted the risks of escalation, as the Houthis vowed to retaliate against U.S. forces.

EU Aspides Mission

In February 2024, the European Union launched Operation Aspides, a maritime security initiative focused on protecting commercial shipping in the Red Sea. The mission includes forces from Belgium, France, Germany, Greece, and Italy and is primarily focused on:

- Intelligence Sharing: Enhancing coordination between EU member states and regional partners to track Houthi movements.

- Naval Patrols: Conducting patrols in high-risk areas to deter attacks and provide escorts for vulnerable vessels.

Challenges:

- Limited Resources: The EU mission operates with a smaller budget and fewer assets compared to Operation Prosperity Guardian, limiting its effectiveness.

- Coordination Issues: Differences in operational priorities among EU member states have hindered the mission’s ability to respond swiftly to threats.

Case Study:

- French Frigate Interception: In March 2024, a French frigate under Operation Aspides intercepted a Houthi drone targeting a commercial vessel. While successful, the incident underscored the need for greater coordination with other coalitions.

Multilateral Diplomacy: Efforts and Obstacles

UN Resolutions and Peace Talks

The United Nations has played a central role in diplomatic efforts to address the Red Sea crisis. Key initiatives include:

- Resolution 2722: Passed in January 2024, the resolution demands that the Houthis cease attacks on commercial vessels and release the hijacked Galaxy Leader and its crew. However, the resolution lacks enforcement mechanisms, limiting its impact.

- Oman-Mediated Talks: Oman has facilitated negotiations between Saudi Arabia and the Houthis, but talks have stalled over disagreements on power-sharing and the status of Houthi-controlled territories.

Challenges:

- Houthi Intransigence: The Houthis have refused to engage in meaningful negotiations unless they are recognized as Yemen’s legitimate government.

- Regional Rivalries: The involvement of Iran and Saudi Arabia in the conflict has complicated diplomatic efforts, as both sides seek to advance their strategic interests.

Case Study:

- Failed Ceasefire Attempts: In 2023, multiple ceasefire agreements brokered by the UN collapsed due to violations by both the Houthis and the Saudi-led coalition.

Regional Diplomacy

Regional actors have also sought to address the crisis through diplomatic channels:

- Gulf Cooperation Council (GCC): The GCC has called for a unified response to the crisis, but internal divisions, particularly between Qatar and Saudi Arabia, have limited its effectiveness.

- Egyptian Mediation: Egypt has proposed a regional security framework to protect Red Sea shipping, but the initiative has yet to gain traction due to competing interests among regional powers.

Challenges:

- Lack of Trust: Deep-seated mistrust between regional actors, particularly Iran and Saudi Arabia, has hindered cooperation.

- Economic Constraints: Many regional states are grappling with economic challenges, limiting their ability to contribute to security efforts.

Economic Costs of Securing Maritime Routes

Funding Challenges

The international response to the Red Sea crisis has placed a significant financial burden on participating nations:

- Operation Prosperity Guardian: Costs $200 million per month, with the U.S. contributing the majority of funding.

- EU Aspides: Operates on a smaller budget of $50 million per month, but funding shortages have limited its scope.

- Humanitarian Aid: Rising costs for aid delivery have strained the budgets of organizations like the WFP and UNICEF, leading to funding gaps of $10 billion in 2024.

Case Study:

- U.S. Defense Budget: The U.S. Department of Defense has requested an additional $2 billion in funding for Operation Prosperity Guardian in 2024, raising concerns about the sustainability of the mission.

Economic Impact on Shipping Companies

| Metric | 2023 | 2025 (Projected) |

|---|---|---|

| War Risk Premiums | 1.0% of cargo value | 1.8% |

| Rerouting Costs | $1M/voyage | $1.4M |

| Naval Ops Spending | $18B annually | $28B |

The crisis has also imposed significant costs on the shipping industry:

- Rerouting Costs: Shipping companies have incurred additional security costs of $1 million per voyage due to longer routes and higher fuel consumption.

- Insurance Premiums: War risk insurance premiums have surged to 1.0% of cargo value, costing the industry $400 million annually. In addition, insurance and security companies have offered those shipping lines and ships carrying more valuable or potentially more attractive goods to attackers on-board security measures, including the presence and assistance of PMCs, which can be costly but unaffordable for some operators.

- Lost Revenue: Reduced shipping volumes through the Red Sea have led to revenue losses of $5 billion for major shipping companies in 2023.

Case Study:

- Maersk’s Financial Report: Maersk reported a 40% increase in operating costs in 2023 due to the Red Sea crisis, despite a surge in freight rates.

Recommendations for Improving International Response

- Enhanced Coordination: Establish a unified command structure for Operation Prosperity Guardian and EU Aspides to improve coordination and resource allocation.

- Diplomatic Engagement: Increase pressure on Iran to cease support for the Houthis and engage in meaningful negotiations.

- Economic Support: Provide financial assistance to regional states and humanitarian organizations to address funding gaps.

- Alternative Routes: Invest in infrastructure for alternative trade routes, such as the India-Middle East-Europe Economic Corridor (IMEC).

- Public Awareness: Launch a global campaign to raise awareness of the humanitarian and economic impacts of the Red Sea crisis.

The international response to the Red Sea crisis has achieved some successes, particularly in deterring Houthi attacks and protecting commercial shipping. However, significant challenges remain, including the risk of escalation, funding constraints, and the complexity of regional power dynamics. To address these challenges, the international community must adopt a coordinated and multifaceted approach that combines military, diplomatic, and economic measures. Without such an approach, the crisis will continue to undermine global trade, exacerbate humanitarian suffering, and destabilize the region.

Conclusions

The Red Sea crisis, instigated by Iranian-backed Houthi attacks, has had a considerable effect on both the global economy and regional geopolitics. Since 2015, these attacks have resulted in a 70% decrease in Red Sea maritime traffic between December 2023 and April 2024, a 30% increase in global freight rates, and additional costs of $1 million per trip for alternative routes. The economic repercussions of the Red Sea crisis are manifold, encompassing a projected 1.2% contraction in GDP growth for the MENA region in 2025, a 22% diminution in Suez Canal revenues for Egypt in 2023, and impediments to the implementation of Saudi Arabia’s Vision 2030 initiative. Significant disruptions have been experienced by sectors such as automotive, electronics, and energy, with Toyota reducing its global production by 6.2% in November 2024 and Saudi Aramco rerouting 40% of crude destined for Europe.

War risk insurance premiums have risen from 0.05% to 1.0% of cargo value, costing the shipping industry over $400 million annually. Geopolitically, the crisis has intensified tensions between Iran and Saudi Arabia, challenging Gulf hegemony, and international operations such as Prosperity Guardian and EU Aspides are struggling to secure maritime routes.Humanitarian aid to Yemen and Sudan has been delayed by weeks, with a 30% increase in aid costs.

The crisis has also given rise to long-term risks, including accelerated deglobalisation, increased resource competition, potential debt crises in countries like Egypt and Pakistan, social instability due to austerity measures and inflation, and a 30% increase in CO2 emissions due to ship rerouting. This multifaceted crisis underscores the urgent need for improved naval cooperation, supply chain diversification, and diplomatic engagement to address the root causes of the Yemeni conflict and mitigate its global consequences.

Throughout 2025 it is to be expected that the Houthis will become a much greater focus of attention for their attacks on Israel, as well as for the emerging need for US coordination with other local actors to undermine one by one the hotspots of the so-called ‘axis of resistance’, even more so with the Gaza focus resolved.

As the hotspots are resolved, both sides will concentrate their resources on the remnants, expect more attacks on their military infrastructure, especially missile sites, but a physical invasion as with Lebanon and Gaza would be extraordinarily rare, given the geographic distance. Nor does the Trump administration’s foreign policy appear to contemplate options beyond bolstering maritime security and supporting its allies in the Zone.

The Houthis themselves will become a greater threat as Iran focuses its arms supply on them, as they no longer have Hamas or Hezbollah as an option, it is quite possible that these supply chains will become the new primary target for intelligence and military action.

On a global scale. Throughout history, maritime trade routes have been a fundamental pillar of the world powers’ moves on the geopolitical chessboard. In this case, it is especially palpable how regional powers are trying to influence and position themselves more and more around these poles of merchandise traffic. The Strait of Malacca, the Panama Canal, the Strait of Gibraltar, the Suez Canal, the Bosphorus, the Strait of Bab al Mandeb, the Strait of Hormuz, or even the Arctic Route, all of them without exception are currently the subject of demands or plans by the world’s major powers.

In the coming years, corridors such as IMEC and BRI will become important not only as trade and development links, but potentially as major logistics and supply coalitions (which will need to develop their own contingency plans) to sustain global economic activities and supply chains in the face of strong protectionist nationalism or de-globalisation initiatives.

References

- Bank of Israel. (2024). The Impact of Houthi Attacks on International Trade: Is Israel an Exception?

- Defense Intelligence Agency. (2024). Yemen: Houthi Attacks Placing Pressure on International Trade.

- UNCTAD. (2024). Navigating Troubled Waters: Impact of Shipping Disruptions.

- IMF PortWatch. (2024). Cargo Shipping Traffic Analysis.

- Lloyd’s List. (2024). War Risk Insurance Trends.

- Reuters. (2023–2024). Red Sea Crisis Updates.

- World Bank. (2024). MENA Economic Outlook.

- U.S. Department of Defense (2024). Operation Prosperity Guardian: Progress Report.

- European Union (2024). Operation Aspides: Mission Overview.

- United Nations (2024). Resolution 2722: Red Sea Security.

- World Food Programme (WFP) (2024). Funding Shortages and Humanitarian Impact.

- Maersk (2023). Annual Financial Report.

- Gulf Cooperation Council (GCC) (2024). Regional Security Initiatives.

- Descifrando la Guerra. Cobertura: Guerra de Yemen (2022 – up to date)

- ACLED. Yemen Conflict Observatory (YCO) (2025)

doi:10.7910/DVN/5MO5NI